Mathematics, 19.10.2020 14:01 carethegymnast8954

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The current yield to maturity on bonds of similar risk is 8 percent. The bonds are currently callable at $1,150. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Another question on Mathematics

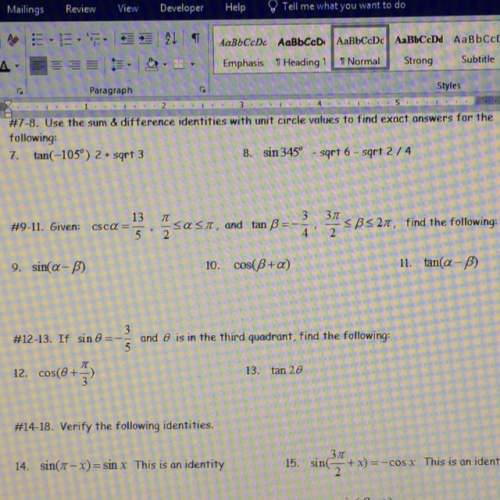

Mathematics, 21.06.2019 22:30

Determine domain and range, largest open interval, and intervals which function is continuous.

Answers: 2

Mathematics, 22.06.2019 00:50

Atravel agent is booking a trip to england, scotland, ireland, and france for a group of senior citizens. the agent sent surveys to the group, asking which countries they would like to visit, in order, and created the shown preference schedule (e = england, i = ireland, s = scotland, f = france). which country is the condorcet winner? number of votes 15 12 16 19 1st f e e i 2nd e s i s 3rd s i s e 4th i f f f 1. scotland 2. england 3. france 4.ireland

Answers: 1

Mathematics, 22.06.2019 02:30

Jonah buys a television that costs $445. sales tax in his state is 7 percent. which of the following expressions represent the amount of tax on the television?

Answers: 3

Mathematics, 22.06.2019 03:00

Run a linear regression to determine an equation (y=mx+b y=mx+b)

Answers: 3

You know the right answer?

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The curr...

Questions

History, 05.01.2021 17:40

English, 05.01.2021 17:40

English, 05.01.2021 17:40

Mathematics, 05.01.2021 17:40

Health, 05.01.2021 17:40

Arts, 05.01.2021 17:40

Chemistry, 05.01.2021 17:40

Computers and Technology, 05.01.2021 17:40

Computers and Technology, 05.01.2021 17:40

English, 05.01.2021 17:40

Mathematics, 05.01.2021 17:40