Mathematics, 21.10.2020 14:01 Homepage10

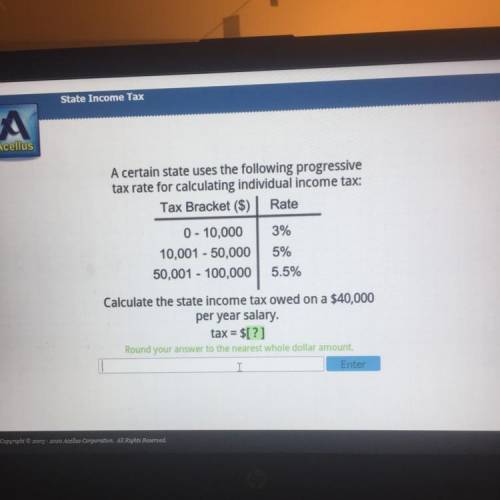

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

3%

0 - 10,000

10,001 - 50,000

50,001 - 100,000

5%

5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $1?1

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Will used 20 colored tiles to make a design in art class. 5/20 of his tiles were red. what is an equivalent fraction for the red tiles?

Answers: 1

Mathematics, 21.06.2019 22:10

What is the circumference of a circle with an area of 50.24 cm²?

Answers: 2

Mathematics, 22.06.2019 01:00

Francis is getting new carpet tiles in his living room and den. his living room and den are connected. he needs to figure out how much carpet he needs and the cost involved. if each tile costs $2.00 per sq ft, how much would it cost to have new tile put in the den? a) $24 b) $36 c) $48 d) $54 plz awnser soon

Answers: 3

Mathematics, 22.06.2019 01:20

Given: δabc, m∠1=m∠2, d∈ ac bd = dc m∠bdc = 100º find: m∠a m∠b, m∠c

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 07.01.2021 16:30

Mathematics, 07.01.2021 16:30

Biology, 07.01.2021 16:30

SAT, 07.01.2021 16:30

English, 07.01.2021 16:30

History, 07.01.2021 16:30

Mathematics, 07.01.2021 16:30

Medicine, 07.01.2021 16:30

Mathematics, 07.01.2021 16:30