Mathematics, 21.10.2020 20:01 Ashley606hernandez

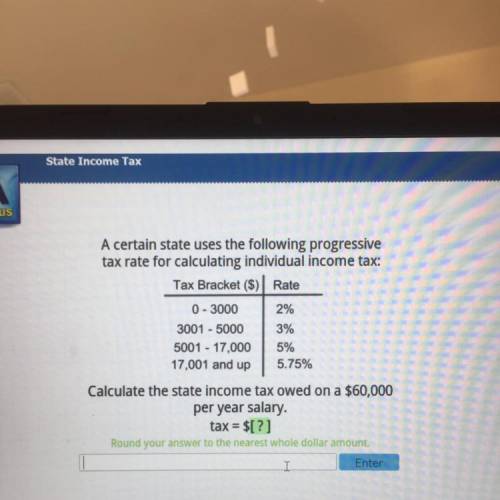

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

0 - 3000 2%

3001 - 5000 3%

5001 - 17,000 5%

17,001 and up 5.75%

Calculate the state income tax owed on a $60,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Entor

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Apatient is to be given 35 milligrams of demerol every 4 hours. you have demerol 50 milligrams/milliliter in stock. how many milliliters should be given per dose?

Answers: 2

Mathematics, 21.06.2019 23:30

The product of sin 30 degrees and sin 60 degrees is same as the product of

Answers: 1

Mathematics, 22.06.2019 01:30

Arace is 10 kilometers long.markers will be placed at the beginning and end of the race course and at each 500 meter mark.how many markers are needed to mark the course for the race?

Answers: 3

Mathematics, 22.06.2019 01:30

Acompany that makes? hair-care products had 5000 people try a new shampoo. of the 5000 ? people, 35 had a mild allergic reaction. what percent of the people had a mild allergic? reaction?

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 24.02.2021 20:10

Mathematics, 24.02.2021 20:10

English, 24.02.2021 20:10

Physics, 24.02.2021 20:10

Mathematics, 24.02.2021 20:10

English, 24.02.2021 20:10

Physics, 24.02.2021 20:10

Chemistry, 24.02.2021 20:10

Spanish, 24.02.2021 20:10

Mathematics, 24.02.2021 20:10

History, 24.02.2021 20:10

Mathematics, 24.02.2021 20:10