Mathematics, 30.10.2020 20:50 jonmorton159

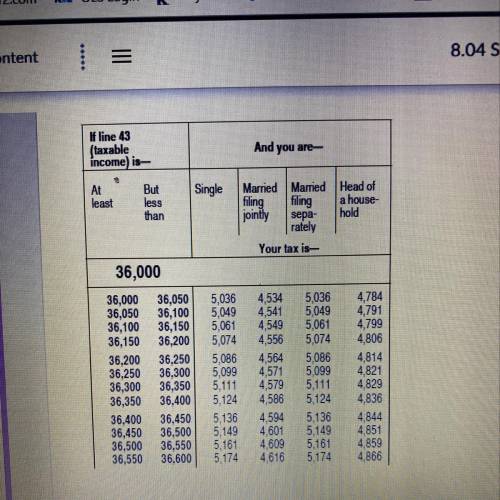

David's taxable income is $36,480. He is filing as married filing jointly, and he has already paid $4047 in federal taxes. What will he receive or pay after he figures his taxes for the year?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 16:00

Determine the relationship of ab and cd given the following points

Answers: 2

Mathematics, 21.06.2019 19:50

98 point question what is the record for most points in one

Answers: 2

Mathematics, 21.06.2019 20:00

Apatient is to be given 35 milligrams of demerol every 4 hours. you have demerol 50 milligrams/milliliter in stock. how many milliliters should be given per dose?

Answers: 2

Mathematics, 21.06.2019 21:00

Asequence has its first term equal to 4, and each term of the sequence is obtained by adding 2 to the previous term. if f(n) represents the nth term of the sequence, which of the following recursive functions best defines this sequence? (1 point) f(1) = 2 and f(n) = f(n − 1) + 4; n > 1 f(1) = 4 and f(n) = f(n − 1) + 2n; n > 1 f(1) = 2 and f(n) = f(n − 1) + 4n; n > 1 f(1) = 4 and f(n) = f(n − 1) + 2; n > 1 i will award !

Answers: 1

You know the right answer?

David's taxable income is $36,480. He is filing as married filing jointly, and he has already paid $...

Questions

Physics, 04.12.2020 22:10

Mathematics, 04.12.2020 22:10

Social Studies, 04.12.2020 22:10

Mathematics, 04.12.2020 22:10

English, 04.12.2020 22:10

Chemistry, 04.12.2020 22:10

English, 04.12.2020 22:10

Mathematics, 04.12.2020 22:10

Physics, 04.12.2020 22:10

Spanish, 04.12.2020 22:10

Biology, 04.12.2020 22:10

Mathematics, 04.12.2020 22:10