Mathematics, 04.12.2020 23:30 bvallinab

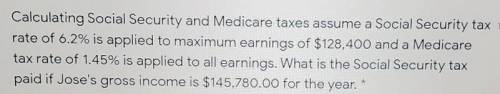

Calculating Social Security and Medicare taxes assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128.400 and a Medicare tax rate of 1.45% is applied to all earnings. What is the Social Security tax paid if Jose's gross income is $145,780.00 for the year. i dont know what to do someone please help

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:00

In a circle, a 45° sector has an area of 32π cm2. what is the radius of this circle? 32 cm 12 cm 16 cm 8 cm

Answers: 3

Mathematics, 21.06.2019 18:30

Which of the following correctly justifies statement four of the two column proof? a. corresponding angles theorem b. transitive property of equality c. vertical angle theorem d. substitution property of equality

Answers: 1

Mathematics, 21.06.2019 20:00

The distribution of the amount of money spent by students for textbooks in a semester is approximately normal in shape with a mean of $235 and a standard deviation of $20. according to the standard deviation rule, how much did almost all (99.7%) of the students spend on textbooks in a semester?

Answers: 2

You know the right answer?

Calculating Social Security and Medicare taxes assume a Social Security tax rate of 6.2% is applied...

Questions

Mathematics, 27.10.2021 22:20

Mathematics, 27.10.2021 22:20

Computers and Technology, 27.10.2021 22:20

Mathematics, 27.10.2021 22:20

Physics, 27.10.2021 22:20

Chemistry, 27.10.2021 22:20

Law, 27.10.2021 22:20

Social Studies, 27.10.2021 22:20

English, 27.10.2021 22:20

Mathematics, 27.10.2021 22:20

English, 27.10.2021 22:20