Mathematics, 28.01.2021 19:50 sweetmochi13

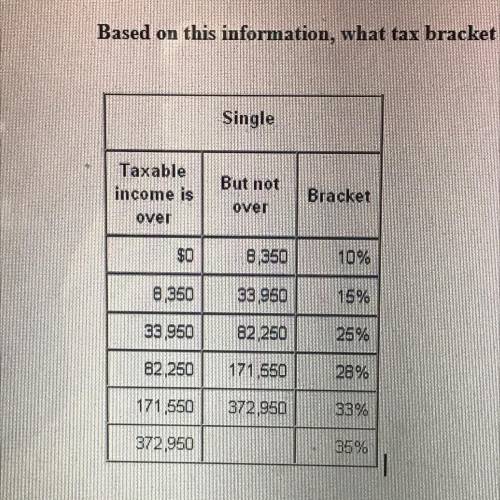

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part time as a medical assistant. Each year she files as Single, takes a standard deduction of $5700 and claims herself as only exemption for $3650. Based on this information, what tax bracket does Monica fall into?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:00

"princess tower" in dubai is considered the world's tallest residential building, towering to 1 0 1 101 floors! t ( n ) t(n) models the number of tenants living on floor n n of the tower. what does the statement t ( 2 0 ) = t ( c ) t(20)=t(c) mean?

Answers: 2

Mathematics, 21.06.2019 16:20

Abank gives 6.5% interest per year. what is the growth factor b in this situation?

Answers: 3

Mathematics, 22.06.2019 01:10

Write each improper fraction as a mixed number. 9/4. 8/3. 23/6. 11/2. 17/5. 15/8. 33/10. 29/12.

Answers: 2

Mathematics, 22.06.2019 02:00

Yolanda wanted to buy a total of 6 pounds of mixed nuts and dried fruit for a party she paid 21.60 for mixed nuts and 11.90 for dried fruit did yolanda but enough mixed nuts and dried fruit for the party

Answers: 2

You know the right answer?

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part...

Questions

Physics, 19.08.2019 12:50

English, 19.08.2019 12:50

Social Studies, 19.08.2019 12:50

History, 19.08.2019 12:50

Mathematics, 19.08.2019 12:50

History, 19.08.2019 13:00

Mathematics, 19.08.2019 13:00

History, 19.08.2019 13:00

Mathematics, 19.08.2019 13:00