Mathematics, 07.11.2019 00:31 BeverlyFarmer

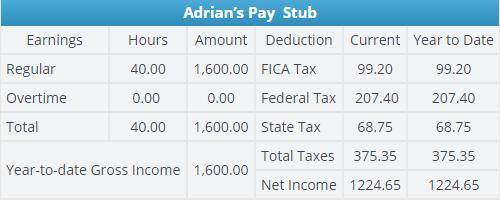

Adrian lives and works in georgia. he earns a gross income of $1,600 each month but gets a net income of $1,224.65. his employer deducts the following taxes from his pay:

tax collected for the irs = $207.40

tax collected for the state of georgia = $68.75

tax collected for social security, medicare, and medicaid = $99.20

write the amount of tax next to the appropriate tax type in adrian’s pay stub.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Me! last question, and i'm stuck! write the algebraic expression that models the word phrase. the product of 2 divided by the number h and 8 more than the number k

Answers: 1

Mathematics, 21.06.2019 17:30

10 ! in a race, nick is 50 feet in front of jay after ten seconds. how fast can nick run, if jay can run 20 feet per second?

Answers: 1

Mathematics, 21.06.2019 18:50

If sr is 4.5cm and tr is 3cm, what is the measure in degrees of angle s?

Answers: 2

You know the right answer?

Adrian lives and works in georgia. he earns a gross income of $1,600 each month but gets a net incom...

Questions

Mathematics, 29.11.2021 18:00

Medicine, 29.11.2021 18:00

English, 29.11.2021 18:00

Geography, 29.11.2021 18:00

Mathematics, 29.11.2021 18:00

History, 29.11.2021 18:00

History, 29.11.2021 18:00

Mathematics, 29.11.2021 18:10

Mathematics, 29.11.2021 18:10

Arts, 29.11.2021 18:10