Mathematics, 08.02.2021 02:50 notchasedeibel6575

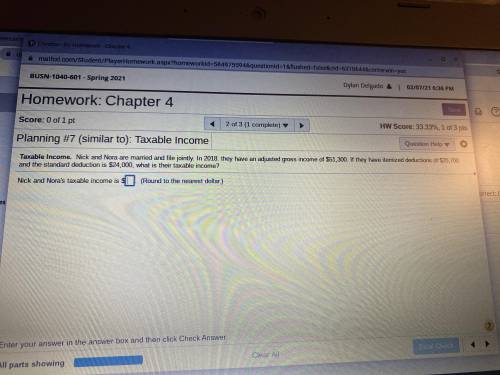

Nick and Nora are married and have three children in college. They have an adjusted gross income of $47,400. If their standard deduction is $12,600, itemized deductions are $14,200, and they get an exemption of $4,000 for each adult and each dependent, what is their taxable income?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:00

The table shows the webster family’s monthly expenses for the first three months of the year. they are $2,687.44, $2,613.09, and $2,808.64. what is the average monthly expenditure for all expenses?

Answers: 1

Mathematics, 21.06.2019 18:30

Players on the school soccer team are selling candles to raise money for an upcoming trip. each player has 24 candles to sell. if a player sells 4 candles a profit of$30 is made. if he sells 12 candles a profit of $70 is made. determine an equation to model his situation?

Answers: 3

Mathematics, 21.06.2019 19:00

Samantha is growing a garden in her back yard. she spend $90 setting up the garden bed and buying the proper garden supplies. in addition, each seed she plants cost $0.25. a. write the function f(x) that represents samantha's total cost on her garden. b. explain what x represents. c. explain what f(x) represents. d. if samantha plants 55 seeds, how much did she spend in total?

Answers: 2

You know the right answer?

Nick and Nora are married and have three children in college. They have an adjusted gross income of...

Questions

Mathematics, 20.10.2020 01:01

History, 20.10.2020 01:01

Social Studies, 20.10.2020 01:01

Physics, 20.10.2020 01:01

Health, 20.10.2020 01:01

History, 20.10.2020 01:01

Mathematics, 20.10.2020 01:01

History, 20.10.2020 01:01

Social Studies, 20.10.2020 01:01

Social Studies, 20.10.2020 01:01

English, 20.10.2020 01:01