Mathematics, 17.02.2021 16:40 mothertrucker2828

Suppose that a US-based company is buying Chinese goods. Current exchange rate for Chinese Yuan is 0.15 USD. The price of goods is ¥13,000 per unit. The company is buying 800 units per year with a fixed contract for the next two years. Suppose that Chinese Yuan appreciate to 0.2 USD in the next year. The US importer will respond to this by lowering the demand to 600 units in the third year. What cash flow will be reflected on the balance of payments at the end of the first year?

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Do some research and find a city that has experienced population growth. determine its population on january 1st of a certain year. write an exponential function to represent the city’s population, y, based on the number of years that pass, x after a period of exponential growth. describe the variables and numbers that you used in your equation.

Answers: 3

Mathematics, 21.06.2019 19:30

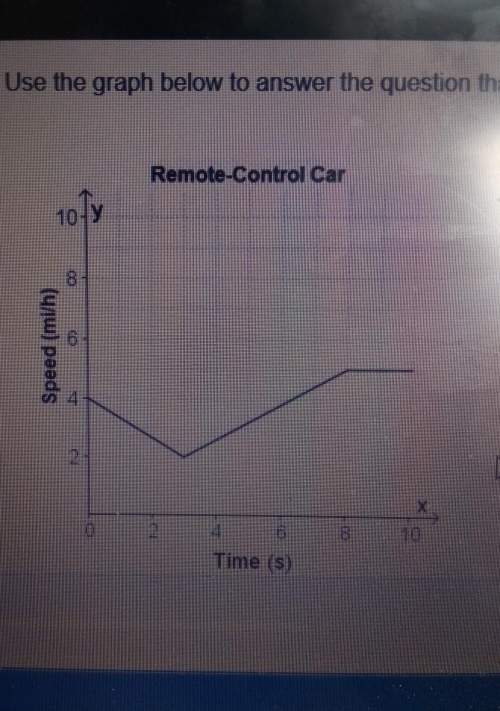

I'm confused on this could anyone me and show me what i need to do to solve it.

Answers: 1

Mathematics, 21.06.2019 19:40

The weights of broilers (commercially raised chickens) are approximately normally distributed with mean 1387 grams and standard deviation 161 grams. what is the probability that a randomly selected broiler weighs more than 1,425 grams?

Answers: 2

Mathematics, 21.06.2019 20:30

Angles r and s are complementary. the measure of angle r is 31 degrees. which equation can be used to find angle s?

Answers: 1

You know the right answer?

Suppose that a US-based company is buying Chinese goods. Current exchange rate for Chinese Yuan is 0...

Questions

Spanish, 26.02.2020 18:24

Arts, 26.02.2020 18:24

Mathematics, 26.02.2020 18:25

Mathematics, 26.02.2020 18:25

Mathematics, 26.02.2020 18:25