April 2013 to April 2014

taxable income = gross income - personal allowance

.

personal...

Mathematics, 26.02.2021 14:00 alexislacour73

April 2013 to April 2014

taxable income = gross income - personal allowance

.

personal allowance is £9205

basic rate of tax: 20% on the first 232 255 of taxable income

higher rate tax 40% is payable on all taxable income over £32255

.

During the tax year 2013 to 2014. Claudia's gross income was £52250

Calculate the total amount of tax that Claudia should pay

You must show al your working

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 13:10

Anthony is making a collage for his art class my picking shapes randomly. he has five squares, two triangles, two ovals, and four circles. find p( circle is chosen first)

Answers: 1

Mathematics, 21.06.2019 14:00

Use the inverse of the function y=x^2-18x to find the unknown value [tex]y = \sqrt{bx + c \: + d} [/tex]

Answers: 3

Mathematics, 21.06.2019 19:00

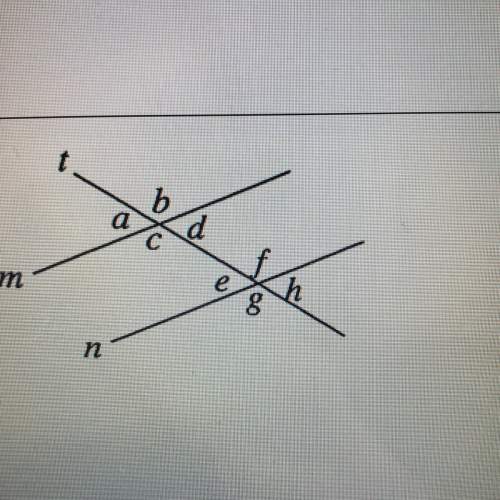

Eis the midpoint of line segment ac and bd also line segment ed is congruent to ec prove that line segment ae is congruent to line segment be

Answers: 3

Mathematics, 21.06.2019 20:50

An automobile assembly line operation has a scheduled mean completion time, μ, of 12 minutes. the standard deviation of completion times is 1.6 minutes. it is claimed that, under new management, the mean completion time has decreased. to test this claim, a random sample of 33 completion times under new management was taken. the sample had a mean of 11.2 minutes. assume that the population is normally distributed. can we support, at the 0.05 level of significance, the claim that the mean completion time has decreased under new management? assume that the standard deviation of completion times has not changed.

Answers: 3

You know the right answer?

Questions

History, 02.10.2019 06:40

Biology, 02.10.2019 06:40

English, 02.10.2019 06:40

Chemistry, 02.10.2019 06:40

Mathematics, 02.10.2019 06:40

Mathematics, 02.10.2019 06:40

History, 02.10.2019 06:40

Biology, 02.10.2019 06:40

Social Studies, 02.10.2019 06:40

English, 02.10.2019 06:40

Mathematics, 02.10.2019 06:40