Mathematics, 05.03.2021 19:30 janeekajones08

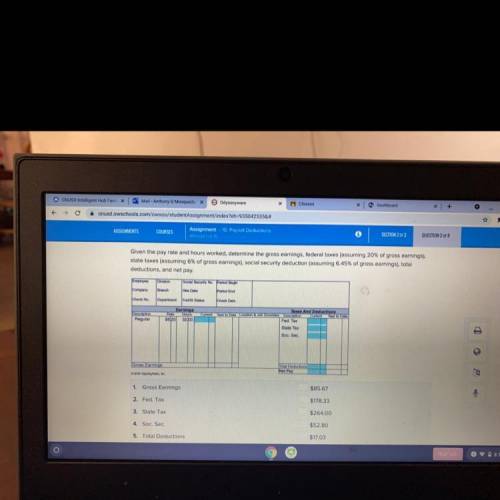

Given the pay rate and hours worked, determine the gross earnings, federal taxes (assuming 20% of gross earnings),

state taxes (assuming 6% of gross earnings), social security deduction (assuming 6.45% of gross earnings), total

deductions, and net pay.

Employee

Division

Social Security No. Perod Bogin

Company

Branch

Hire Date

Period End

Check No

Department Fed St Status

Check Date

Earnings

Rate

$8.25 32.00

HOUS

Cunun

Descnption

Regular

Year to Date

Taxes And Deductions

Location & Job Overdes Description Curend Year to Date

Fed. Tax

State Tax

Soc. Sec

Gross Earnings

Total Deductions

Net Pay

2000

Our

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Ariel is working at a meat packing plant for 5 nights a week. her regular wage is $11 an hour. she earns tine and a half for any overtime hours. this week she worked 9 hours of over time .how much will ariel earn for overtime this week ?

Answers: 1

Mathematics, 21.06.2019 21:00

Eliza wants to make $10,000 from her investments. she finds an investment account that earns 4.5% interest. she decides to deposit $2,500 into an account. how much money will be in her account after 14 years?

Answers: 1

Mathematics, 21.06.2019 21:00

*let m∠cob = 50°30’, m∠aob = 70° and m∠aoc = 20°30’. could point c be in the interior of ∠aob? why?

Answers: 1

You know the right answer?

Given the pay rate and hours worked, determine the gross earnings, federal taxes (assuming 20% of gr...

Questions

Mathematics, 13.11.2020 02:30

Health, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

History, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

SAT, 13.11.2020 02:30

Spanish, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

French, 13.11.2020 02:30

English, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30

Health, 13.11.2020 02:30

Mathematics, 13.11.2020 02:30