Mathematics, 09.03.2021 07:20 kdfawesome5582

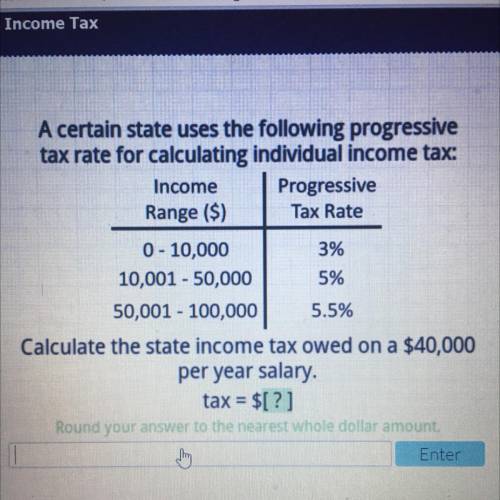

Please help! It would be much appreciated. A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($)

Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 18:40

Which of the following represents the range of the graph of f(x) below

Answers: 1

Mathematics, 21.06.2019 20:30

Graph the line that represents a proportional relationship between d and t with the property that an increase of 33 units in t corresponds to an increase of 44 units in d. what is the unit rate of change of dd with respect to t? (that is, a change of 11 unit in t will correspond to a change of how many units in d? )

Answers: 3

Mathematics, 21.06.2019 23:00

*segment an is an altitude of right ? abc with a right angle at a. if ab = 2root 5 in and nc = 1 in, find bn, an, ac.

Answers: 3

Mathematics, 22.06.2019 00:20

One file clerk can file 10 folders per minute. a second file clerk can file 11 folders per minute. how many minutes would the two clerks together take to file 672 folders?

Answers: 1

You know the right answer?

Please help! It would be much appreciated. A certain state uses the following progressive

tax rate...

Questions

Biology, 18.02.2021 05:10

Mathematics, 18.02.2021 05:10

Mathematics, 18.02.2021 05:10

Mathematics, 18.02.2021 05:10

English, 18.02.2021 05:10

Mathematics, 18.02.2021 05:10

Geography, 18.02.2021 05:10

Mathematics, 18.02.2021 05:10

Mathematics, 18.02.2021 05:10