Mathematics, 11.03.2021 01:00 Hammon1774

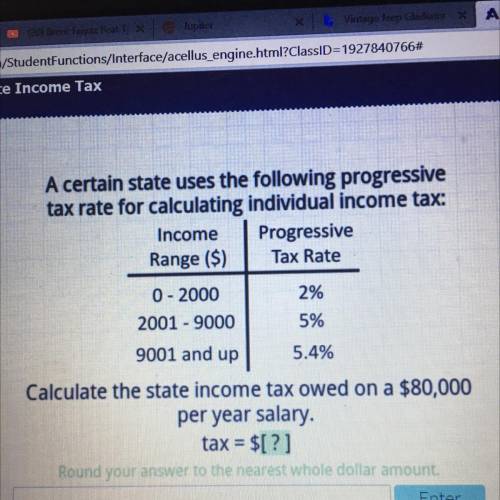

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up

5.4%

Calculate the state income tax owed on a $80,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:00

According to modern science, earth is about 4.5 billion years old and written human history extends back about 10,000 years. suppose the entire history of earth is represented with a 10-meter-long timeline, with the birth of earth on one end and today at the other end.

Answers: 2

Mathematics, 21.06.2019 20:00

For problems 29 - 31 the graph of a quadratic function y=ax^2 + bx + c is shown. tell whether the discriminant of ax^2 + bx + c = 0 is positive, negative, or zero.

Answers: 1

Mathematics, 22.06.2019 03:20

The equation ip| = 2 represents the total number of points that can be earned or lost during one turn of a game. which best describes how many points can be earned or lost during one turn?

Answers: 3

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 01.05.2021 18:30

Mathematics, 01.05.2021 18:30

Mathematics, 01.05.2021 18:30

Mathematics, 01.05.2021 18:30

Mathematics, 01.05.2021 18:30

Computers and Technology, 01.05.2021 18:30

Mathematics, 01.05.2021 18:30

Spanish, 01.05.2021 18:30

History, 01.05.2021 18:30