Mathematics, 19.03.2021 06:20 ueuwuwj

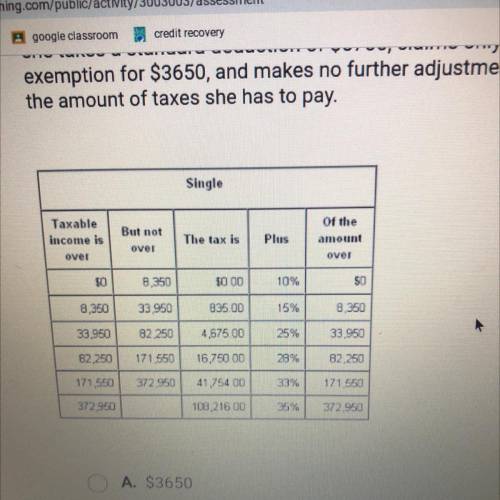

A nutritionist filling her federal income tax retum with the Single filing status

had a gross income of $34,200. She made a $1000 contribution to an IRA. If

she takes a standard deduction of $5700, claims only herself as an

exemption for $3650, and makes no further adjustment to her income, find

the amount of taxes she has to pay.

A. S3650

B. $2560

C. $8400

D. S3160

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 20:20

The polynomial 10x3 + 35x2 - 4x - 14 is factored by grouping. 10x3 + 35x2 - 4x - 14 5x )-20 what is the common factor that is missing from both sets of parentheses?

Answers: 2

Mathematics, 21.06.2019 23:30

Darren earned $663.26 in net pay for working 38 hours. he paid $118.51 in federal and state income taxes, and $64.75 in fica taxes. what was darren's hourly wage? question options: $17.45 $19.16 $20.57 $22.28

Answers: 3

Mathematics, 21.06.2019 23:40

What is the equation, in point-slope form, of the line that has a slope of 6 and passes through the point (–1, –8)? a. y+8 = 6 (x+1 )

Answers: 1

You know the right answer?

A nutritionist filling her federal income tax retum with the Single filing status

had a gross incom...

Questions

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Arts, 12.12.2020 15:50

English, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Chemistry, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50