Mathematics, 19.03.2021 21:10 ghadeeraljelawy

Expected rate of return and risk - B. J. Gautney enterprises is evaluating a security. One year treasury bills are currently paying 4.3 %. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security?

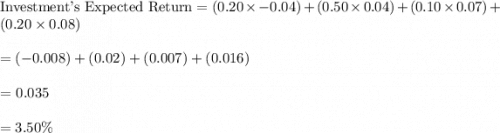

Probability/ return: 0.20/ -4%; 0.50/ 4%; 0.10/ 7%; 0.20/ 8%.

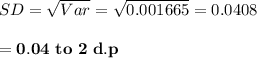

The investment's expected return is _% (round the two decimal places)

The investment's standard deviation is % (round the two decimal places)

Should Gautney invest in this security? (select the best choice below)

a) yes. B. J. Gautney Enterprices should invest in this investment because the return is lower than treasury bill and the level of risk higher than the treasury bill.

B) no. B. J. Gautney Enterprises should not invest in this investment because the return is lower than the treasury bill and the level of risk higher than the treasury bill.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:30

You can find the constant of proportionality by finding the ratio of

Answers: 1

Mathematics, 21.06.2019 17:30

One line passes through (-7,-4) and (5,4) . another line passes through the point (-4,6) and (6,-9)

Answers: 1

Mathematics, 21.06.2019 18:30

Identify the polynomial. a2b - cd3 a.monomial b.binomial c.trinomial d.four-term polynomial e.five-term polynomial

Answers: 1

Mathematics, 21.06.2019 22:30

The difference of three and the reciprocal of a number is equal to the quotient of 20 and the number. find the number.

Answers: 2

You know the right answer?

Expected rate of return and risk - B. J. Gautney enterprises is evaluating a security. One year trea...

Questions

Computers and Technology, 21.06.2021 15:50

Physics, 21.06.2021 15:50

Computers and Technology, 21.06.2021 15:50

Biology, 21.06.2021 15:50

Computers and Technology, 21.06.2021 15:50

![Var (r) = [(-0.04- 0.035)^2 * 0.2] + [(0.04 - 0.035)^2 * 0.5] + [(0.07 - 0.035)^2 * -0.10] + [(0.08 - 0.035)^2 * 0.20] \\ \\ = (-5*10^{-6} )+(1.25*10^{-5})+(-1.225*10^{-4}) + (4.05 \times 10^{-4}) \\ \\= 0.001665](/tpl/images/1207/8661/8baa5.png)