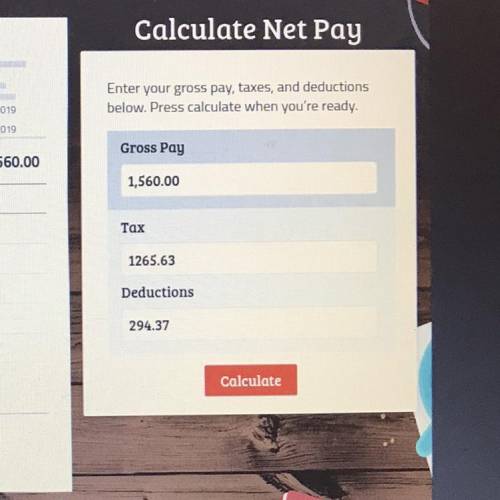

Calculate Net Pay

Start period 02/01/2019

End period 021512019

Enter your gross pay, ta...

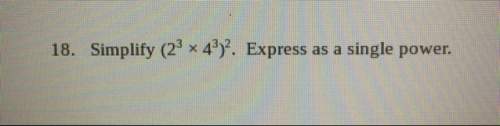

Mathematics, 23.03.2021 18:30 fryday2516

Calculate Net Pay

Start period 02/01/2019

End period 021512019

Enter your gross pay, taxes, and deductions

below. Press calculate when you're ready.

Gross Pay

Gross Pay

$1,560.00

1,560.00

Earnings

Taxes

Deductions

$1.560.00

Federal (7.57%) = $11809

Tax

FICA Medicare (1255) = 522 62

1265.63

FICA Social Security (6 202) = 596.72

Deductions

State-OK 3.65%) = $55.94

294.37

Total = $294.37

Net Pay

Calculate

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Given f(x)=2x^2-8x+6 and g(x)=3x-1 find f(x) +g(x) a. 2x^2+5x+5 b.2x^2-11x+7 c. 2x^2-5x+5 d.2x^2-5x-5

Answers: 1

Mathematics, 21.06.2019 23:40

Which of the following is best modeled using a linear equation y=ax+b, where a is less than 0?

Answers: 2

You know the right answer?

Questions

Mathematics, 01.09.2019 22:10

English, 01.09.2019 22:10

History, 01.09.2019 22:10

Mathematics, 01.09.2019 22:10

Biology, 01.09.2019 22:10

History, 01.09.2019 22:10

Mathematics, 01.09.2019 22:10

History, 01.09.2019 22:10

English, 01.09.2019 22:10

Physics, 01.09.2019 22:10

Business, 01.09.2019 22:10