Mathematics, 07.04.2021 18:00 bettybales1986

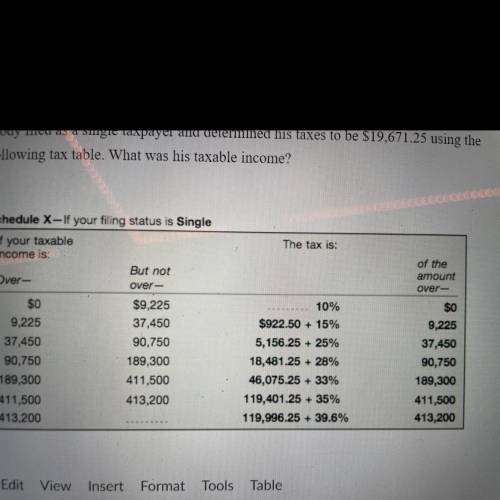

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the following tax table. What was his taxable income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 23:50

Apolynomial has two terms. check all of the factoring methods that should be considered. common factor difference of cubes sum of cubes difference of squares perfect-square trinomial factoring by grouping

Answers: 3

Mathematics, 22.06.2019 03:30

If bradley saves for 4 weeks, what is the total amount of money he will have saved?

Answers: 1

Mathematics, 22.06.2019 04:00

Aaron paid $9.75 for markers that cost $0.75 each. he bought 4 times as many pencils for $0.35 each. how much did aaron pay for pencils?

Answers: 1

You know the right answer?

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the

following tax t...

Questions

Mathematics, 23.09.2019 15:30

History, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30

Health, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30

Mathematics, 23.09.2019 15:30