Mathematics, 08.04.2021 20:40 meaghan18

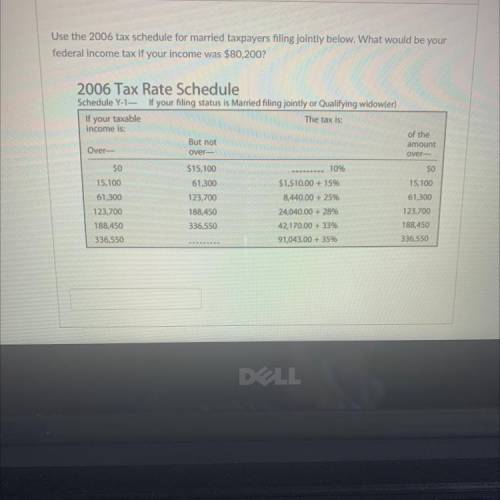

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal income tax if your income was $80,200?

2006 Tax Rate Schedule

Schedule Y-1- If your filing status is Married filing jointly or Qualifying widow(er)

If your taxable

The tax is:

income is:

But not

Over-

over-

of the

amount

over-

10%

$1,510.00 + 15%

$0

15,100

61,300

123,700

188,450

336,550

$15,100

61,300

123,700

188,450

336,550

8,440.00 + 25%

24,040.00 + 28%

42,170.00 + 33%

91,043.00 + 3596

$0

15,100

61,300

123,700

188,450

336,550

M

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Of the ones listed here, the factor that had the greatest impact on the eventual destruction of native americans' ways of life was the development of the a) automobile. b) highway. c) railroad. d) steamboat.

Answers: 3

Mathematics, 21.06.2019 17:00

Parks is wearing several rubber bracelets one third of the bracelets are tie-dye 1/6 are blue and 1/3 of the remainder are camouflage if parks wears 2 camouflage bracelets how many bracelets does he have on

Answers: 2

Mathematics, 21.06.2019 18:40

Which statements regarding efg are true? check all that apply.

Answers: 1

Mathematics, 21.06.2019 22:20

Which of the following describes how to translate the graph y = |x| to obtain the graph of y = |x+1|+1? shift 1 unit left and 1 unit down shift 1 unit left and 1 unit up shift 1 unit night and 1 unit down shift 1 unit nght and 1 unit up

Answers: 1

You know the right answer?

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal in...

Questions

History, 18.03.2021 02:10

Mathematics, 18.03.2021 02:10

Biology, 18.03.2021 02:10

English, 18.03.2021 02:10

Mathematics, 18.03.2021 02:10

English, 18.03.2021 02:10

Mathematics, 18.03.2021 02:10

Physics, 18.03.2021 02:10

English, 18.03.2021 02:10