Mathematics, 11.04.2021 03:40 makylahoyle

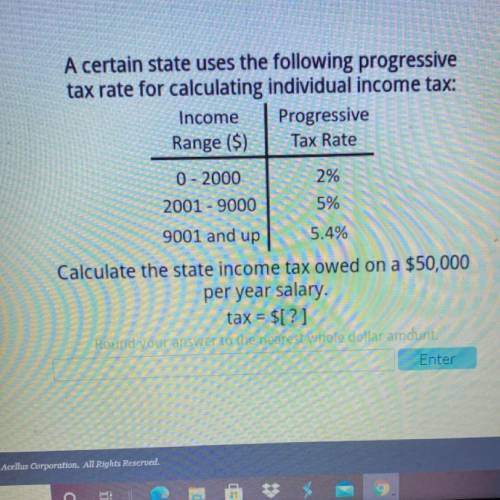

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2001 - 9000

2%

5%

9001 and up

5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Click on the y intercept. -x +4 i know you cant click on it so could you just say the coordinates like (example - (1,0) you so much.

Answers: 2

Mathematics, 21.06.2019 18:00

What can you determine about the solutions of this system

Answers: 1

Mathematics, 21.06.2019 20:00

The boiling point of water at an elevation of 0 feet is 212 degrees fahrenheit (°f). for every 1,000 feet of increase in elevation, the boiling point of water decreases by about 2°f. which of the following represents this relationship if b is the boiling point of water at an elevation of e thousand feet? a) e = 2b - 212 b) b = 2e - 212 c) e = -2b + 212 d) b = -2e + 212

Answers: 1

Mathematics, 21.06.2019 21:30

Aboard 60 in. long is cut two parts so that the longer piece is 5 times the shorter. what are the length of the two pieces?

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 01.02.2020 01:02

Mathematics, 01.02.2020 01:02

Mathematics, 01.02.2020 01:02

Arts, 01.02.2020 01:02

History, 01.02.2020 01:02

Mathematics, 01.02.2020 01:02