Mathematics, 11.05.2021 01:00 genyjoannerubiera

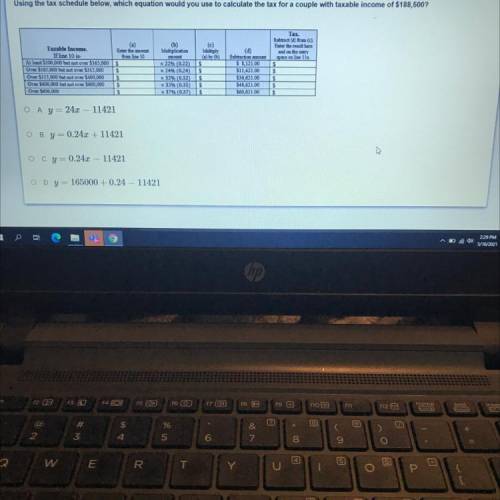

Using the tax schedule below, which equation would you use to calculate the tax for a couple with taxable income of $188,500?

Taxable Income.

If line 10 is-

At least $100,000 but not over $165,000

Over $165,000 but not over $315,000

Over $315,000 but not over $400,000

Over $400,000 but not over $600,000

Over $600,000

(a)

Enter the amount

from line 10

$

$

$

$

s

(6)

(c)

Multiplication

Multiply

amount (a) by )

x 22% (0.22) S

x 24% (0.24) S

X 32% 0.32) $

x 35% (0.35) s

x 37% (0.37) IS

(d)

Subtraction amount

$ 8,121.00

$11,421.00

$36,621.00

$48.621.00

$60,621.00

Tax.

Subtract (d) from (c)

Enter the result here

and on the entry

space on line 112

$

S

$

$

$

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 14:40

Asequence is defined recursively by the formula f(n + 1) = f(n) + 3 . the first term of the sequence is –4. what is the next term in the sequence? –7–117

Answers: 1

Mathematics, 21.06.2019 17:20

Acredit card advertises an annual interest rate of 23%. what is the equivalent monthly interest rate?

Answers: 1

Mathematics, 21.06.2019 23:10

Carly stated, “all pairs of rectangles are dilations.” which pair of rectangles would prove that carly’s statement is incorrect?

Answers: 1

Mathematics, 21.06.2019 23:30

Arestaurant added a new outdoor section that was 8 feet wide and 6 feet long. what is the area of their new outdoor section

Answers: 1

You know the right answer?

Using the tax schedule below, which equation would you use to calculate the tax for a couple with ta...

Questions

Spanish, 24.08.2019 10:00

Mathematics, 24.08.2019 10:00

Biology, 24.08.2019 10:00

Mathematics, 24.08.2019 10:00

English, 24.08.2019 10:00

Mathematics, 24.08.2019 10:00

Arts, 24.08.2019 10:00

Mathematics, 24.08.2019 10:00

Social Studies, 24.08.2019 10:00