Review the federal income tax table.

Single

If Taxable income is between:

Then the Tax...

Mathematics, 24.05.2021 07:10 dlasheab

Review the federal income tax table.

Single

If Taxable income is between:

Then the Tax Due Is:

$0 - 59700

10% of taxable income

$9701 - $39,475

$970+12% of the amount over $9700

$39,476 - $84.200

$4543+22% of the amount over $39,475

$84.201 - $160.725

$14.382.50+24% of the amount over $84,200

$ 160,726 - $204,100

$32,748.50+32% of the amount over $160.725

$204,101 - $510.300

$46.628.50+35% of the amount over $204.100

$153.798.50+37% of the amount over $510.300

$510.301+

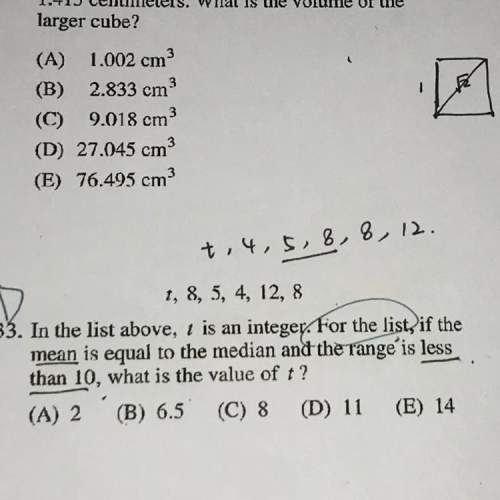

Mustafa earned $95,000 in taxable income in a year from his job as a software developer How much federal income tax

does he owe? Enter your answer as a number rounded to the nearest cent such as: $42, 536.47

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:00

Solve the word problem. the table shows the low outside temperatures for monday, tuesday, and wednesday. by how many degrees did the low temperature increase from monday to tuesday? this function table shows the outside temperature for a given a. 21.1⁰ b. 8.6⁰ c. 4.9⁰ d. 3.9⁰(the picture is the graph the the question is talking about.)

Answers: 1

Mathematics, 21.06.2019 23:40

Determine the standard form of the equation of the line that passes through (-2,0) and (8,-5)

Answers: 1

Mathematics, 22.06.2019 00:00

The letters g e o r g i a are placed in a bag . if you picked a card and knew it was a vowel , what is the probability that it is an a ?

Answers: 1

You know the right answer?

Questions

Law, 28.09.2020 14:01

History, 28.09.2020 14:01

English, 28.09.2020 14:01

Chemistry, 28.09.2020 14:01

Biology, 28.09.2020 14:01

History, 28.09.2020 14:01

Chemistry, 28.09.2020 14:01

Medicine, 28.09.2020 14:01

History, 28.09.2020 14:01

Arts, 28.09.2020 14:01

English, 28.09.2020 14:01

History, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01

Mathematics, 28.09.2020 14:01