Mathematics, 03.06.2021 06:10 yusufamin876

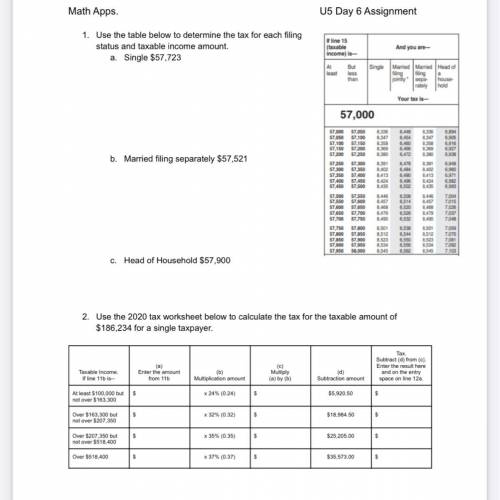

1. Use the table below to determine the tax for each filing status and taxable income amount.

a. Single $57,723

U5 Day 6 Assignment

b. Married filing separately $57,521

c. Head of Household $57,900

2. Use the 2020 tax worksheet below to calculate the tax for the taxable amount of $186,234 for a single taxpayer.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:00

Which statement best explains why ben uses the width hi to create the arc at j from point k

Answers: 2

Mathematics, 21.06.2019 20:00

Can someone factor this fully? my friend and i have two different answers and i would like to know if either of them is right. you in advance. a^2 - b^2 + 25 + 10a

Answers: 1

You know the right answer?

1. Use the table below to determine the tax for each filing status and taxable income amount.

a. Si...

Questions

Mathematics, 21.07.2019 06:30

Mathematics, 21.07.2019 06:30

History, 21.07.2019 06:30

English, 21.07.2019 06:30