Mathematics, 20.06.2021 21:30 joe7977

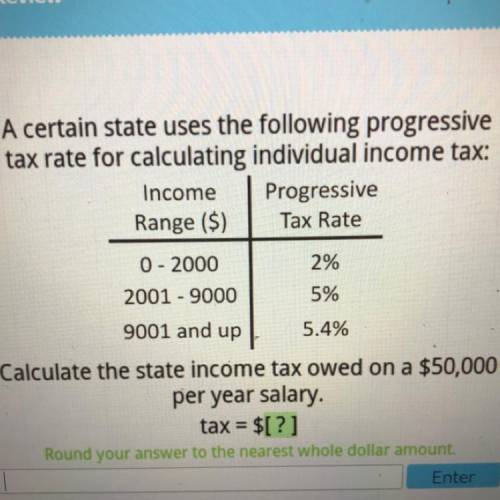

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000

5%

9001 and up

5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:30

Adding and subtracting matricesfind the value of each variable. x = and y = would

Answers: 3

Mathematics, 22.06.2019 01:00

Is experimental probibilty the same as the observed frequency in math? i need the answer asap!

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 28.08.2019 06:00

Business, 28.08.2019 06:00

History, 28.08.2019 06:00

Biology, 28.08.2019 06:00

Mathematics, 28.08.2019 06:00

Mathematics, 28.08.2019 06:00

Biology, 28.08.2019 06:00

History, 28.08.2019 06:00