Mathematics, 31.07.2021 19:40 Madisonk3571

HIGH POINTS + BRAINLIEST

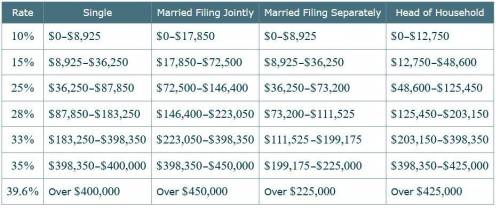

Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $8,925, 15% tax on the amount over $8,925 up to $36,250, and 25% in the amount over $36,250 up to $ 40,000.

If Abdul and Maria had a filing status of Married Filing Jointly and together have a taxable income of $91,307 in the year 2013, how much did the couple owe for federal income tax?

Do not round any intermediate computations. Round your answer to the nearest dollar.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:50

The number of fish in a lake can be modeled by the exponential regression equation y=14.08 x 2.08^x where x represents the year

Answers: 3

Mathematics, 21.06.2019 22:30

Solve: 25 points find the fifth term of an increasing geometric progression if the first term is equal to 7−3 √5 and each term (starting with the second) is equal to the difference of the term following it and the term preceding it.

Answers: 1

You know the right answer?

HIGH POINTS + BRAINLIEST

Each row shows the tax rate on a specific portion of the taxpayer's taxabl...

Questions

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

English, 26.02.2021 23:10

Computers and Technology, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10

Mathematics, 26.02.2021 23:10