Mathematics, 17.08.2021 21:20 jennaranelli05

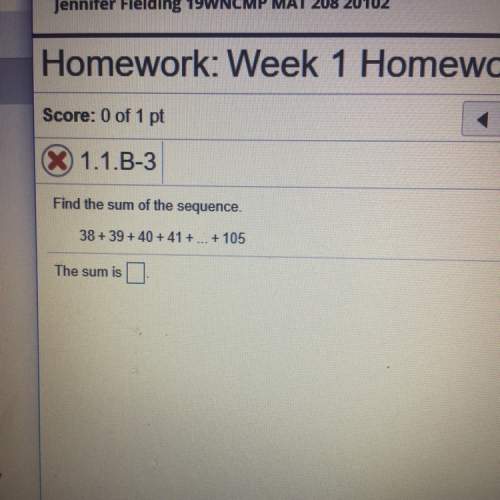

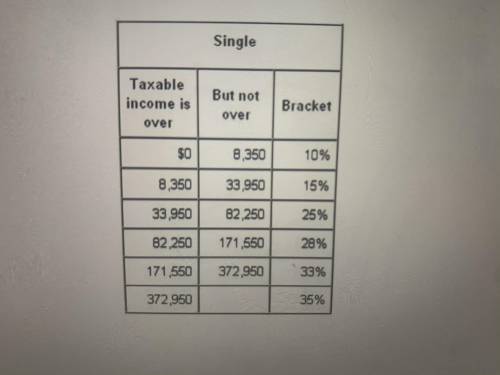

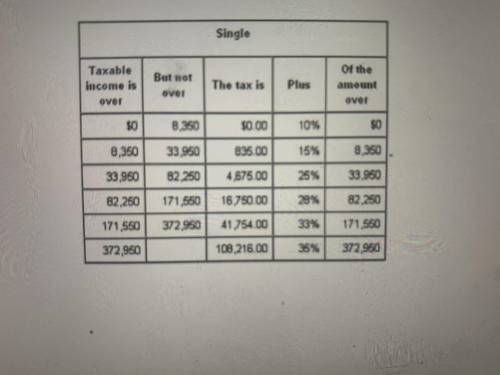

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part time as a medical assistant. Each year she filed taxes as Single, takes a standard deduction of $5700 and claims herself as only exemption for $3650. Based on this information, what tax bracket does Monica fall into? (First picture) Using the information from a previous problem, calculate the amount of taxes Monica owes. (Second picture)

Answers: 3

Another question on Mathematics

Mathematics, 22.06.2019 00:30

Me i’m stuck on all these questions besides the two bottom ones

Answers: 2

Mathematics, 22.06.2019 01:10

If the probability of an event happening is 65% then the probability this event does not occur?

Answers: 1

Mathematics, 22.06.2019 03:00

Gabrielle's age is three times mikhail's age. the sum of their ages is 40 . what is mikhail's age? __ years old

Answers: 2

Mathematics, 22.06.2019 05:30

Writing proportions. no solving. write all of them ! extraaa points.

Answers: 2

You know the right answer?

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part...

Questions

Spanish, 15.12.2020 22:10

Mathematics, 15.12.2020 22:10

Geography, 15.12.2020 22:10

Mathematics, 15.12.2020 22:10

Social Studies, 15.12.2020 22:10

History, 15.12.2020 22:10

History, 15.12.2020 22:10

Chemistry, 15.12.2020 22:10

Physics, 15.12.2020 22:10

SAT, 15.12.2020 22:10

English, 15.12.2020 22:10