Mathematics, 10.09.2021 14:00 mremoney530

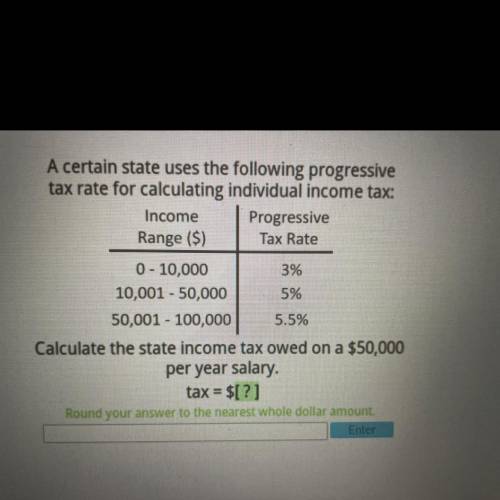

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 22:20

Atriangle has verticals at b(-3,0), c(2,-1), d(-1,2). which transformation would produce an image with verticals b”(-2,1), c”(3,2), d”(0,-1)?

Answers: 2

Mathematics, 21.06.2019 22:30

5. (04.07)which of the following exponential functions goes through the points (1, 12) and (2, 36)? (2 points)f(x) = 3(4)^xf(x) = 4(3)^-xf(x) = 3(4)^-xf(x) = 4(3)^x

Answers: 1

Mathematics, 21.06.2019 23:00

The price of a car has been reduced from $19,000 to $11,590. what is the percentage decrease of the price of the car?

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Health, 22.07.2019 02:30

Social Studies, 22.07.2019 02:30

Mathematics, 22.07.2019 02:30

Mathematics, 22.07.2019 02:30

Social Studies, 22.07.2019 02:30

Mathematics, 22.07.2019 02:30

Social Studies, 22.07.2019 02:30

Chemistry, 22.07.2019 02:30

Geography, 22.07.2019 02:30