Mathematics, 20.09.2021 19:00 KittyGotham

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 10,000

3%

10,001 - 50,000 5%

50,001 - 100,000 5.5%

Calculate the state income tax owed on a $90,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 2

Another question on Mathematics

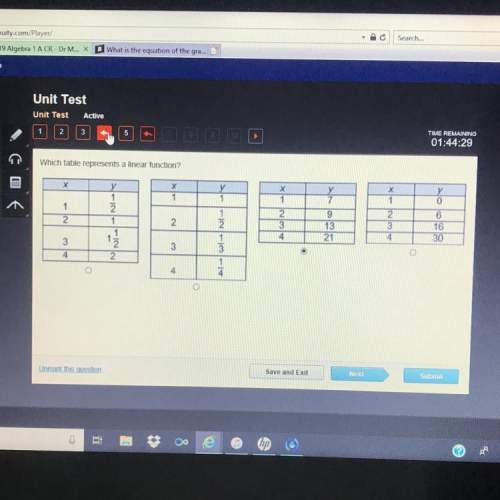

Mathematics, 21.06.2019 13:30

Which point is a solution to the inequality shown in this graph (-3,-3)(3,-1)

Answers: 2

Mathematics, 21.06.2019 21:30

Data from 2005 for various age groups show that for each $100 increase in the median weekly income for whites, the median weekly income of blacks increases by $105. also, for workers of ages 25 to 54 the median weekly income for whites was $676 and for blacks was $527. (a) let w represent the median weekly income for whites and b the median weekly income for blacks, and write the equation of the line that gives b as a linear function of w. b = (b) when the median weekly income for whites is $760, what does the equation in (a) predict for the median weekly income for blacks?

Answers: 2

Mathematics, 21.06.2019 21:40

Use sigma notation to represent the following series for 9 terms.

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

Mathematics, 05.05.2020 08:43

Mathematics, 05.05.2020 08:43

Arts, 05.05.2020 08:43

Mathematics, 05.05.2020 08:43

Physics, 05.05.2020 08:43

Biology, 05.05.2020 08:43

Computers and Technology, 05.05.2020 08:43

Mathematics, 05.05.2020 08:43

Mathematics, 05.05.2020 08:43

Mathematics, 05.05.2020 08:43