Review the federal income tax table.

Single

If Taxable Income Is between: Then the Tax Due I...

Mathematics, 09.10.2021 08:30 babysisjessica1

Review the federal income tax table.

Single

If Taxable Income Is between: Then the Tax Due Is:

$0 – $9700 10% of taxable income

$9701 – $39,475 $970+12% of the amount over $9700

$39,476 – $84,200 $4543+22% of the amount over $39,475

$84,201 – $160,725 $14,382.50+24% of the amount over $84,200

$160,726 – $204,100 $32,748.50+32% of the amount over $160,725

$204,101 – $510,300 $46,628.50+35% of the amount over $204,100

$510,301+ $153,798.50+37% of the amount over $510,300

Mustafa earned $95,000 in taxable income in a year from his job as a software developer. How much federal income tax does he owe? Enter your answer as a number rounded to the nearest cent, such as: $42,536.47.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 20:00

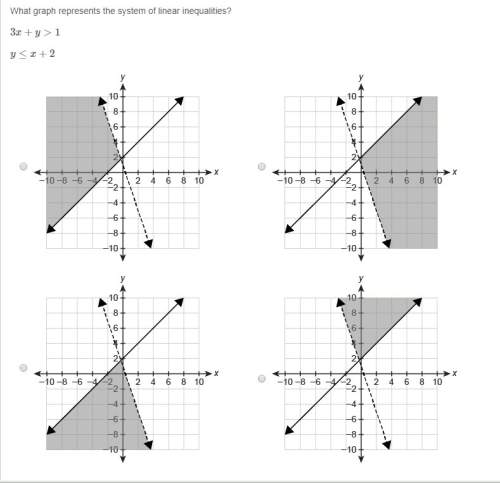

Graph the linear function using the slooe and y intercept

Answers: 2

Mathematics, 21.06.2019 21:00

Factor the trinomial below. 12x^2 - 32x - 12 a. 4(3x+3)(x-1) b. 4(3x+1)(x-3) c. 4(3x+6)(x-2) d. 4(3x+2)(x-6)

Answers: 2

Mathematics, 21.06.2019 21:00

Which must be true in order for the relationship △zyv ~ △xwv to be correct? zy ∥ wx ∠z ≅ ∠y and ∠w ≅ ∠x zv ≅ vy and wv ≅ vx ∠z ≅ ∠x and ∠w ≅ ∠y

Answers: 2

You know the right answer?

Questions

Advanced Placement (AP), 07.06.2021 19:20

Mathematics, 07.06.2021 19:20

Mathematics, 07.06.2021 19:20

History, 07.06.2021 19:20

English, 07.06.2021 19:20

Mathematics, 07.06.2021 19:20

Mathematics, 07.06.2021 19:20

Social Studies, 07.06.2021 19:20

Physics, 07.06.2021 19:20

Mathematics, 07.06.2021 19:20