Mathematics, 11.11.2021 06:50 ImmortalEnigmaYT

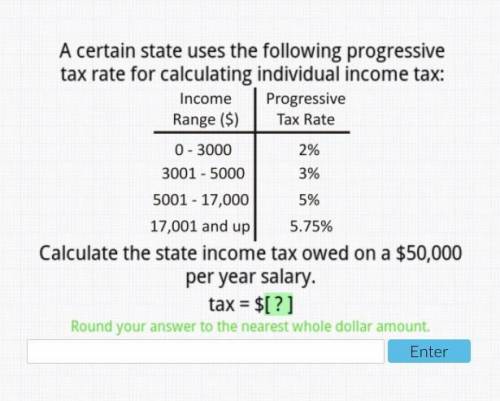

A certain state uses the following progressive tax rate for calculating individual income tax:

Income Range ($) Progressive Tax Rate

0-3000 2%

3001-5000 3%

5001-17,000 5%

17,001 and up 5.75%

Calculate the state income tax owed on a $50,000 per year salary.

tax = $[ ]

Round your answer to the nearest whole dollar amount.

*NEED HELP ASAP!*

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:20

Can (3,5 and square root 34) be sides on a right triangle?

Answers: 1

Mathematics, 21.06.2019 18:00

Write the equation for the parabola that has x− intercepts (−2,0) and (4,0) and y− intercept (0,4).

Answers: 1

Mathematics, 21.06.2019 18:00

Ihave trouble finding the nth term of a linear sequence

Answers: 2

You know the right answer?

A certain state uses the following progressive tax rate for calculating individual income tax:

Inc...

Questions

History, 06.07.2019 14:00

Computers and Technology, 06.07.2019 14:00

English, 06.07.2019 14:00

Health, 06.07.2019 14:00

History, 06.07.2019 14:00

Mathematics, 06.07.2019 14:00

Physics, 06.07.2019 14:00

Mathematics, 06.07.2019 14:00

Mathematics, 06.07.2019 14:00

History, 06.07.2019 14:00

Spanish, 06.07.2019 14:00