Mathematics, 22.11.2021 23:10 jcece9055

In the 01 July 2016, Samsung Ltd acquired the machine A by $1,502,000. Estimated useful life is 10 years, estimated residual value is $2,000. Company uses straight-line method for depreciation. From 2019, Samsung Ltd measure the machine A by the revaluation model. At 30 June 2019, machine A was revalued to $ 1,400,000. After one year, at 30 June 2020, machine A was revalued to $1,000,000. At 30 June 2021, machine A was revalued to $1,500,000. Required: Prepare the journal entries from 01 July 2016 to 30 June 2021. (using both method for revaluation)

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 21:40

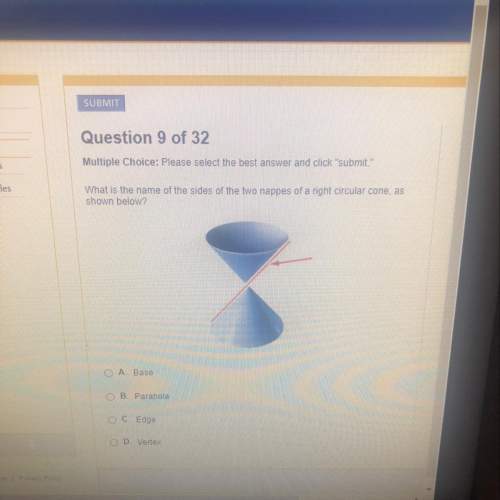

Drag the tiles to the correct boxes to complete the pairs. using the properties of integer exponents, match each expression with the correct equivalent expression.

Answers: 1

Mathematics, 22.06.2019 00:00

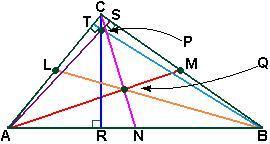

The statements below can be used to prove that the triangles are similar. ? △abc ~ △xyz by the sss similarity theorem. which mathematical statement is missing? ∠b ≅ ∠y ∠b ≅ ∠z

Answers: 2

You know the right answer?

In the 01 July 2016, Samsung Ltd acquired the machine A by $1,502,000. Estimated useful life is 10 y...

Questions

Chemistry, 05.05.2021 22:10

Mathematics, 05.05.2021 22:10

History, 05.05.2021 22:10

Mathematics, 05.05.2021 22:10

Mathematics, 05.05.2021 22:10

Mathematics, 05.05.2021 22:10

Geography, 05.05.2021 22:10

Social Studies, 05.05.2021 22:10

Social Studies, 05.05.2021 22:10

Mathematics, 05.05.2021 22:10

Chemistry, 05.05.2021 22:10

Mathematics, 05.05.2021 22:10

English, 05.05.2021 22:10