Mathematics, 06.12.2021 20:30 ChristLover2863

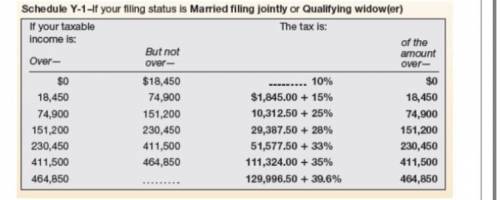

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. They were able to reduce their total income by $25,381 with deductions. Using Form 1040 and Schedule A, how much was their tax by taking these deductions? Use the schedule below.

Answers: 3

Another question on Mathematics

Mathematics, 20.06.2019 18:04

Arectangle has an area of 54 square feet. if the length is 3 feet more than the width, find the dimensions of the rectangle.

Answers: 2

Mathematics, 21.06.2019 15:10

Which system of linear inequalities is graphed? can somebody pleasssse

Answers: 3

Mathematics, 21.06.2019 18:30

Find the exact value of each of the following. in each case, show your work and explain the steps you take to find the value. (a) sin 17π/6 (b) tan 13π/4 (c) sec 11π/3

Answers: 2

You know the right answer?

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. T...

Questions

Advanced Placement (AP), 28.10.2020 18:10

English, 28.10.2020 18:10

Geography, 28.10.2020 18:10