Mathematics, 15.12.2021 01:50 destinycasillas

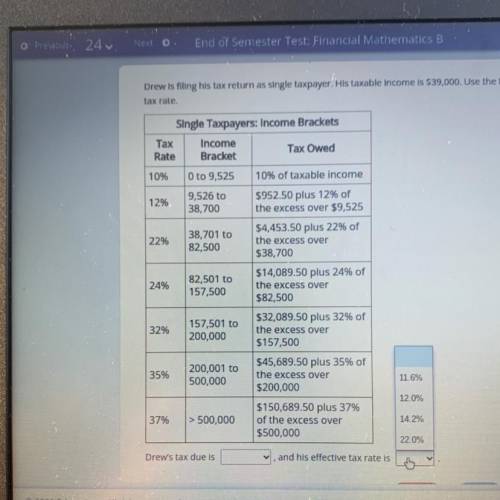

Drew is filling his tax return as single taxplayer. His taxable income is 39,000. Use the tax table provided to compute Drew’s tax due and effective tax Rate. Drew’s tax due is <4,519.50 or 4,680.00 or 5,525.25 or 8,580.00>, and his effective tax rate is <11.6% or 12.0% or 14.2% or 22.0%>

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 22:00

If abcde is reflected over the x-axis and then translated 3 units left, what are the new coordinates d? are he re

Answers: 1

Mathematics, 22.06.2019 02:00

Graph a triangle (xyz) and reflect it over the line y=x to create triangle x’y’z’. describe the transformation using words. draw a line segment from point x to the reflecting line, and then draw a line segment from point x’ to the reflecting line. what do you notice about the two line segments you drew? do you think you would see the same characteristics if you drew the line segment connecting y with the reflecting line and then y’ with the reflecting line? how do you know?

Answers: 1

Mathematics, 22.06.2019 02:30

Abby is collecting rainfall data. she finds that one value of the data set is a high-value outlier. which statement must be true? abby will use a different formula for calculating the standard deviation. the outlier will increase the standard deviation of the data set. the spread of the graph of the data will not change. abby will not use the mean when calculating the standard deviation.

Answers: 3

You know the right answer?

Drew is filling his tax return as single taxplayer. His taxable income is 39,000. Use the tax table...

Questions

Mathematics, 27.07.2019 11:40

Mathematics, 27.07.2019 11:40

History, 27.07.2019 11:40

English, 27.07.2019 11:40

History, 27.07.2019 11:40

Social Studies, 27.07.2019 11:40

History, 27.07.2019 11:40