Mathematics, 12.03.2022 14:00 juniorvalencia4

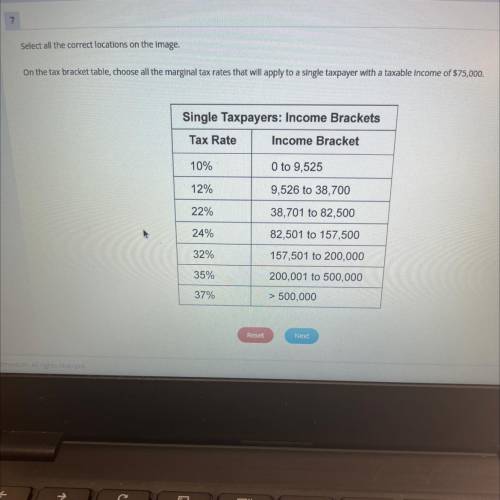

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer with a taxable income of $75,000.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

12%

9,526 to 38,700

22%

38,701 to 82,500

24%

82,501 to 157,500

32%

157,501 to 200,000

35%

200,001 to 500,000

37%

> 500,000

Reset

Next

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:30

In parallelogram abcd the ratio of ab to bcis 5: 3. if the perimeter of abcd is 32 find ab

Answers: 1

Mathematics, 21.06.2019 23:30

Darren earned $663.26 in net pay for working 38 hours. he paid $118.51 in federal and state income taxes, and $64.75 in fica taxes. what was darren's hourly wage? question options: $17.45 $19.16 $20.57 $22.28

Answers: 3

Mathematics, 22.06.2019 00:00

Last week jason walked 3 1/4 miles each day for 3 days and 4 5/8 miles each day for 4 days. about how many miles did jason walk last week?

Answers: 1

Mathematics, 22.06.2019 00:30

Taber invested money in an account where interest is compounded every year.he made no withdrawals or deposits. the function a(t)=525(1+0.05)^t represent the amount of money in the account after t years. how much money did taber origanally invested?

Answers: 1

You know the right answer?

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer wit...

Questions

History, 23.08.2019 17:50

French, 23.08.2019 17:50

Social Studies, 23.08.2019 17:50

Biology, 23.08.2019 17:50

History, 23.08.2019 17:50

History, 23.08.2019 17:50

Social Studies, 23.08.2019 17:50

Health, 23.08.2019 17:50

English, 23.08.2019 17:50

Mathematics, 23.08.2019 17:50