Mathematics, 12.03.2022 15:40 ilovebeanieboos

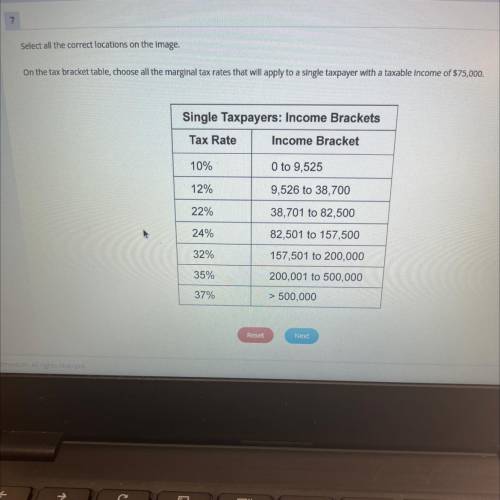

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer with a taxable income of $75,000.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

12%

9,526 to 38,700

22%

38,701 to 82,500

24%

82,501 to 157,500

32%

157,501 to 200,000

35%

200,001 to 500,000

37%

> 500,000

Reset

Next

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:30

Your food costs are $5,500. your total food sales are $11,000. what percent of your food sales do the food costs represent?

Answers: 2

Mathematics, 21.06.2019 23:00

Which equation is equivalent to the given expression? -(1/2y+1/4) a. -1/4(1+2y) b. 1/4(2y-1) c. -2(1/4y-1/8) d. 2(1/8-1/4y)

Answers: 1

Mathematics, 22.06.2019 00:30

Bocephus has a bag full of nickels and dimes. if there are 3 times as many dimes as nickels, and he has $\$36.05$ in his bag, how many nickels does he have?

Answers: 1

Mathematics, 22.06.2019 02:00

Asap! will mark brainliest! ( respond asap, it's urgent! : )) what is the slope for equation y =-3x + 8

Answers: 2

You know the right answer?

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer wit...

Questions

History, 25.06.2019 12:00

Health, 25.06.2019 12:00

Physics, 25.06.2019 12:00

Computers and Technology, 25.06.2019 12:00

Mathematics, 25.06.2019 12:00

History, 25.06.2019 12:00

Mathematics, 25.06.2019 12:00

History, 25.06.2019 12:00

Mathematics, 25.06.2019 12:00

Mathematics, 25.06.2019 12:00

Chemistry, 25.06.2019 12:00

History, 25.06.2019 12:00