Mathematics, 03.07.2019 07:40 live4dramaoy0yf9

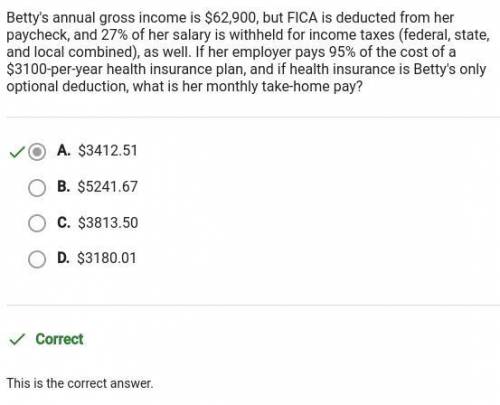

Betty's annual gross income is $62,900, but fica is deducted from her paycheck, and 27% of her salary is withheld for income taxes (federal, state, and local combined), as well. if her employer pays 95% of the cost of a $3100-per-year health insurance plan, and if health insurance is betty's only optional deduction, what is her monthly take-home pay?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:00

Idont understand math at all! : o( use this scenario to answer the remaining questions: brenton purchased a new bedroom set for $4,500.00. he lives in arizona and pays a 8.75% sales tax. if he made a 50% down payment and financed the rest, what amount did he finance? what is the total sales tax brenton will pay? enter your answer in currency format, round to the nearest cent. what was brenton's total amount financed? enter your answer in currency format, round to the nearest cent.

Answers: 3

Mathematics, 22.06.2019 00:30

What should be done to both sides of the equation in order to solve -5m = -40? a) multiply by -5. b) divide by -5. c) multiply by -40. d) divide by -40.

Answers: 2

Mathematics, 22.06.2019 01:00

Luisa sells stuffed animals. she sells her stuffed elephant for $34.90, and the sales tax is 6% of the sale price. about how much is the sales tax on the elephant?

Answers: 2

Mathematics, 22.06.2019 01:20

Which function is represented by the graph? a. f(x)=|x-1|+3 b. f(x)=|x+1|-3 c. f(x)=|x-1|-3 d. f(x)=|x+1|+3

Answers: 1

You know the right answer?

Betty's annual gross income is $62,900, but fica is deducted from her paycheck, and 27% of her salar...

Questions

Business, 23.04.2021 15:40

Social Studies, 23.04.2021 15:40

Computers and Technology, 23.04.2021 15:40

History, 23.04.2021 15:40

Mathematics, 23.04.2021 15:40

Mathematics, 23.04.2021 15:40