Mathematics, 04.07.2019 08:30 AM28

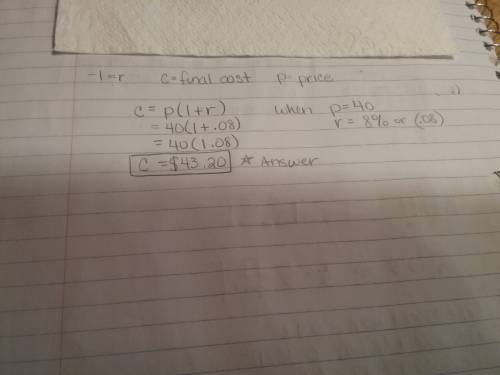

The tax rate as a percent, r, charged on an item can be determined using the formula – 1 = r, where c is the final cost of the item and p is the price of the item before tax. louise rewrites the equation to solve for the final cost of the item: c = p(1 + ). what is the final cost of a $40 item after an 8% tax is applied?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:00

What were mkh company's cash flows from (for) operating activities in 20x1? $(180,300) $233,100 $268,200 $279,400?

Answers: 2

Mathematics, 21.06.2019 21:40

The management of a supermarket wants to adopt a new promotional policy of giving a free gift to every customer who spends more than a certain amount per visit at this supermarket. the expectation of the management is that after this promotional policy is advertised, the expenditures for all customers at this supermarket will be normally distributed with a mean of $95 and a standard deviation of $20. if the management wants to give free gifts to at most 10% of the customers, what should the amount be above which a customer would receive a free gift?

Answers: 2

Mathematics, 22.06.2019 01:40

The tree filled 3/4 of a cup in 1/2 and hour at what rate does syurup flow from the tree

Answers: 1

You know the right answer?

The tax rate as a percent, r, charged on an item can be determined using the formula – 1 = r, where...

Questions

Chemistry, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

Biology, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

History, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

Business, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25

History, 19.05.2020 03:25

Mathematics, 19.05.2020 03:25