Mathematics, 06.11.2019 10:31 cgarnett5408

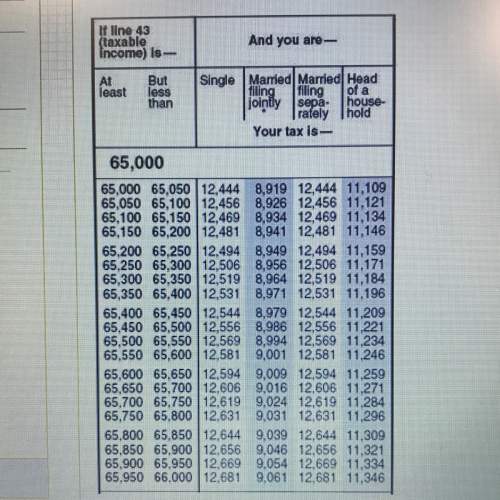

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does he have to pay if he files with the “single” status? a.) $9,024 b.) $9,031 c.) $12,631 d.) $12,619

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Ialready asked this but i never got an answer. will give a high rating and perhaps brainliest. choose the linear inequality that describes the graph. the gray area represents the shaded region. y ≤ –4x – 2 y > –4x – 2 y ≥ –4x – 2 y < 4x – 2

Answers: 1

Mathematics, 21.06.2019 20:30

If g^-1(x) is the inverse of g (x) which statement must be true

Answers: 3

You know the right answer?

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does...

Questions

Chemistry, 02.09.2021 09:50

Social Studies, 02.09.2021 09:50

Mathematics, 02.09.2021 09:50

Mathematics, 02.09.2021 09:50

Mathematics, 02.09.2021 09:50

Social Studies, 02.09.2021 09:50

Geography, 02.09.2021 09:50

Chemistry, 02.09.2021 09:50

Mathematics, 02.09.2021 14:00