Mathematics, 08.11.2019 04:31 rileyeddins1010

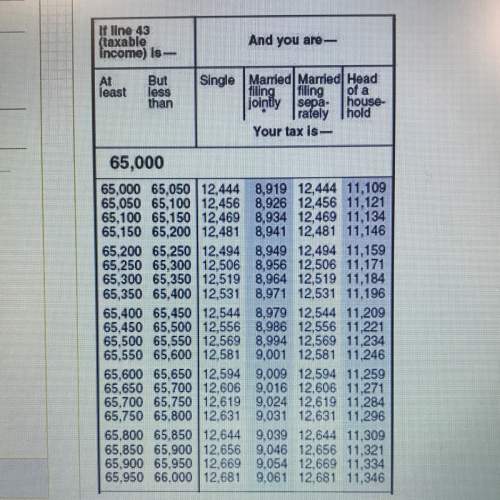

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does he have to pay if he files with the “single” status? a.) $9,024 b.) $9,031 c.) $12,631 d.) $12,619

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 19:20

Askyscraper is 396 meters tall. at a certain time of day, it casts a shadow that is 332 meters long.at what angle is the sun above the horizon at that time?

Answers: 1

Mathematics, 21.06.2019 21:20

Amajor grocery store chain is trying to cut down on waste. currently, they get peaches from two different distributors, whole fruits and green grocer. out of a two large shipments, the manager randomly selects items from both suppliers and counts the number of items that are not sell-able due to bruising, disease or other problems. she then makes a confidence interval. is there a significant difference in the quality of the peaches between the two distributors? 95% ci for pw-pg: (0.064, 0.156)

Answers: 3

Mathematics, 21.06.2019 21:40

Use sigma notation to represent the following series for 9 terms.

Answers: 2

You know the right answer?

Gregory’s taxable income last year was $65,750. according to the tax table below, how much tax does...

Questions