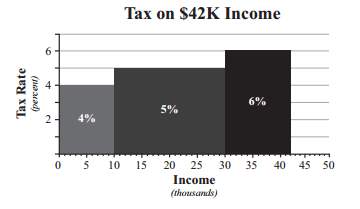

In alaya’s home state, an individual’s income tax is calculated as follows:

• 4% on any porti...

Mathematics, 29.11.2019 07:31 lizzyhearts

In alaya’s home state, an individual’s income tax is calculated as follows:

• 4% on any portion of income less than or equal to $10,000, plus

• 5% on any portion of income greater than $10,000 but less than or

equal to $30,000, plus

• 6% on any portion of income over $30,000.

the figure shows how the state income tax is calculated for an income of

$42,000. if alaya paid $3200 in state income tax, what was his income?

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Given: m∠ adb = m∠cdb ad ≅ dc prove: m∠ bac = m∠bca lol

Answers: 2

Mathematics, 21.06.2019 18:40

Offering 30 if a plus b plus c equals 68 and ab plus bc plus ca equals 1121, where a, b, and c are all prime numbers, find the value of abc. the answer is 1978 but i need an explanation on how to get that.

Answers: 3

Mathematics, 21.06.2019 20:00

The table shows the age and finish time of ten runners in a half marathon. identify the outlier in this data set. drag into the table the ordered pair of the outlier and a reason why that point is an outlier.

Answers: 1

Mathematics, 21.06.2019 20:30

In the diagram of circle o, what is the measure of zabc?

Answers: 2

You know the right answer?

Questions

Arts, 04.05.2021 14:20

English, 04.05.2021 14:20

English, 04.05.2021 14:20

English, 04.05.2021 14:20

Mathematics, 04.05.2021 14:20

Mathematics, 04.05.2021 14:20

Mathematics, 04.05.2021 14:20

Mathematics, 04.05.2021 14:20

Mathematics, 04.05.2021 14:20

English, 04.05.2021 14:30

Mathematics, 04.05.2021 14:30

Mathematics, 04.05.2021 14:30