Mathematics, 18.10.2019 15:20 jalenshayewilliams

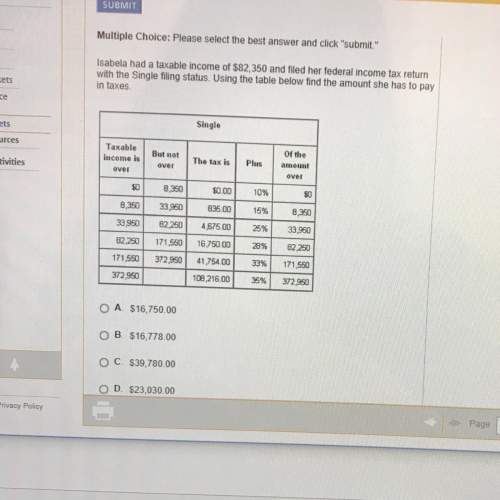

Isabela had a taxable income of $82350 and filed her federal income tax return with the single filing status. using the table below find the amount she has to pay in taxes.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:20

Which function is increasing? o a. f(x)=(1/15)* o b. f(x)= (0.5)* o c. f(x)=(1/5)* o d. f(x) = 5*

Answers: 1

Mathematics, 21.06.2019 19:50

On a piece of paper graft y+2> -3x-3 then determine which answer matches the graph you drew

Answers: 2

Mathematics, 21.06.2019 20:10

Heather is writing a quadratic function that represents a parabola that touches but does not cross the x-axis at x = -6. which function could heather be writing? fx) = x2 + 36x + 12 = x2 - 36x - 12 f(x) = -x + 12x + 36 f(x) = -x? - 12x - 36

Answers: 1

You know the right answer?

Isabela had a taxable income of $82350 and filed her federal income tax return with the single filin...

Questions

Mathematics, 29.01.2020 17:54

Mathematics, 29.01.2020 17:54

History, 29.01.2020 17:54

Mathematics, 29.01.2020 17:54

Mathematics, 29.01.2020 17:54

History, 29.01.2020 17:54

Physics, 29.01.2020 17:54

Geography, 29.01.2020 17:54

English, 29.01.2020 17:54

Computers and Technology, 29.01.2020 17:54

Mathematics, 29.01.2020 17:54

Social Studies, 29.01.2020 17:54