Mathematics, 28.07.2019 06:00 molliemoo1002

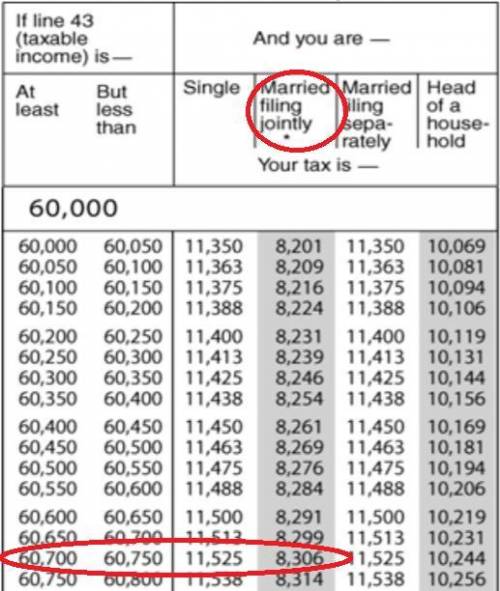

Chris’ taxable income is $60,709. she is married, filing jointly. what is her tax?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 22:30

Find the condition that the zeros of the polynomial f(x) = x^3+3px^2+3px+r may be in a.p.

Answers: 1

Mathematics, 21.06.2019 23:30

Identify the slope an intercept of the following linear equation y = 1/5x - 6 a. slope: 1/5; intercept: -6 b. slope: 5; intercept: -6 c. slope: -1/5; intercept: 6 d. slope: 1/5; intercept: 6

Answers: 2

Mathematics, 22.06.2019 01:00

Mia’s gross pay is 2953 her deductions total 724.15 what percent if her gross pay is take-home pay

Answers: 1

Mathematics, 22.06.2019 02:50

Triangle dog was rotated to create triangle d'o'g'. describe the transformation using details and degrees.

Answers: 3

You know the right answer?

Chris’ taxable income is $60,709. she is married, filing jointly. what is her tax?...

Questions

Biology, 06.05.2020 23:13

English, 06.05.2020 23:13

Biology, 06.05.2020 23:13

Mathematics, 06.05.2020 23:13

Social Studies, 06.05.2020 23:13

Mathematics, 06.05.2020 23:13

Mathematics, 06.05.2020 23:13

Biology, 06.05.2020 23:13

Mathematics, 06.05.2020 23:13

Mathematics, 06.05.2020 23:13

Biology, 06.05.2020 23:13

Mathematics, 06.05.2020 23:13