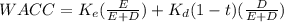

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 million at the end of the first year, and these savings will grow at a rate of 3 percent per year indefinitely. the firm has a target debt-equity ratio of .85, a cost of equity of 11.9 percent, and an aftertax cost of debt of 4.7 percent. the cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects. what is the maximum initial cost the company would be willing to pay for the project?

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 09:50

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

Business, 22.06.2019 17:30

Jeanie had always been interested in how individuals and businesses effectively allocate their resources in order to accomplish personal and organizational goals. that’s why she majored in economics and took on an entry-level position at an accounting firm. she is very interested in further advancing her career by looking into a specialization that builds upon her academic background, and her interest in deepening her understanding of how companies adjust their operating results to incorporate the economic impacts of their practices on internal and external stakeholders. which specialization could jeanie follow to get the best of both worlds? jeanie should chose to get the best of both worlds.

Answers: 2

You know the right answer?

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 mi...

Questions

English, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

History, 27.12.2020 20:40

Health, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

Chemistry, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40

Mathematics, 27.12.2020 20:40