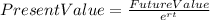

Kevin wants to buy a bond that will mature to 5500 in seven years. how much should he pay for the bond now if it earns interest at a rate of 2% per year, compounded continuously? do not round any intermediate computations, and round your answer to the nearest cent.

Answers: 2

Another question on Business

Business, 21.06.2019 16:50

New team of management has taken over. as a result, organizational changes from a country-club style leadership where everyone does whatever they want has changed to a more mechanistic, structured, top-down management style. what ethical issues should the employees consider and how should they go about addressing these?

Answers: 2

Business, 22.06.2019 18:00

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

Business, 23.06.2019 04:00

If a transformational leader is supposed to be so smart and visionary, why would he or she emphasize empowerment in his or her leadership approach?

Answers: 3

Business, 23.06.2019 07:00

Choose all that apply. a financially-responsible person has a budget has no plan spends less than they make pays for everything with a credit card saves their money pays bills on time

Answers: 1

You know the right answer?

Kevin wants to buy a bond that will mature to 5500 in seven years. how much should he pay for the bo...

Questions

History, 02.04.2020 22:36

History, 02.04.2020 22:36

Mathematics, 02.04.2020 22:36

Mathematics, 02.04.2020 22:36

World Languages, 02.04.2020 22:36

Mathematics, 02.04.2020 22:36

Mathematics, 02.04.2020 22:36

Mathematics, 02.04.2020 22:36

Mathematics, 02.04.2020 22:36