Business, 16.10.2019 02:20 mwilliams457

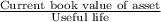

An intangible asset with an estimated useful life of 30 years was acquired on january 1, 2007, for $540,000. on january 1, 2017, a review was made of intangible assets and their expected service lives, and it was determined that this asset had an estimated useful life of 30 more years from the date of the review. what is the amount of amortization for this intangible in 2017

Answers: 2

Another question on Business

Business, 22.06.2019 04:10

An outside manufacturer has offered to produce 60,000 daks and ship them directly to andretti's customers. if andretti company accepts this offer, the facilities that it uses to produce daks would be idle; however, fixed manufacturing overhead costs would be reduced by 75%. because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two-thirds of their present amount. what is andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer?

Answers: 3

Business, 22.06.2019 08:30

What has caroline's payment history been like? support your answer with two examples

Answers: 3

Business, 22.06.2019 15:00

Which of the following is least likely to a team solve problems together

Answers: 1

Business, 22.06.2019 18:30

> > objectives define federalism and explain why the framers adopted a federal system instead of a unitary system. categorize powers delegated to and denied to the national government, and powers reserved for and denied to the states, and the difference between exclusive and concurrent powers.

Answers: 1

You know the right answer?

An intangible asset with an estimated useful life of 30 years was acquired on january 1, 2007, for $...

Questions

Mathematics, 22.04.2020 21:55

Social Studies, 22.04.2020 21:55

History, 22.04.2020 21:55

Physics, 22.04.2020 21:56

Chemistry, 22.04.2020 21:56

English, 22.04.2020 21:56

Mathematics, 22.04.2020 21:56