Business, 07.11.2019 02:31 monstergirl25

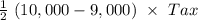

Suppose a tax is imposed on each new hearing aid that is sold. the supply curve is a typical upward-sloping straight line, and the demand curve is a typical downward-sloping straight line. as a result of the tax, the equilibrium quantity of hearing aids decreases from 10,000 to 9,000, and the deadweight loss of the tax is $60,000. we can conclude that the tax on each hearing aid is:

Answers: 3

Another question on Business

Business, 21.06.2019 22:50

Synovec co. is growing quickly. dividends are expected to grow at a rate of 24 percent for the next three years, with the growth rate falling off to a constant 7 percent thereafter. if the required return is 11 percent, and the company just paid a dividend of $2.05, what is the current share price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers: 2

Business, 22.06.2019 09:00

What should a food worker use to retrieve ice from an ice machine?

Answers: 1

Business, 22.06.2019 11:30

11. before adding cream to a simmering soup, you need to a. simmer the cream. b. chill the cream. c. strain the cream through cheesecloth. d. allow the cream reach room temperature. student d incorrect which answer is right?

Answers: 2

Business, 22.06.2019 17:30

Kevin and jenny, who are both working full-time, have three children all under the age of ten. the two youngest children, who are three and five years old, attended eastside pre-school for a total cost of $3,000. ervin, who is nine, attended big kid daycare after school at a cost of $2,000. jenny has earned income of $15,000 and kevin earns $14,000. what amount of childcare expenses should be used to determine the child and dependent care credit?

Answers: 3

You know the right answer?

Suppose a tax is imposed on each new hearing aid that is sold. the supply curve is a typical upward-...

Questions

History, 30.06.2019 23:50

Social Studies, 30.06.2019 23:50

Mathematics, 30.06.2019 23:50

Biology, 30.06.2019 23:50

History, 30.06.2019 23:50

Arts, 30.06.2019 23:50

Spanish, 30.06.2019 23:50

Social Studies, 30.06.2019 23:50

Biology, 30.06.2019 23:50

Biology, 30.06.2019 23:50

Arts, 30.06.2019 23:50

Arts, 30.06.2019 23:50

Biology, 30.06.2019 23:50

Mathematics, 30.06.2019 23:50