Acompany is considering buying a new piece of machinery. a 10% interest rate will be used in the computations. two models of the machine are available.

machine i

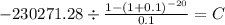

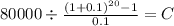

initial cost: $80,000

end -of -useful –life salvage value, s: 20,000

annual operating cost 18,000

useful life, in years 20

machine ii

initial cost: $100,000

end -of -useful –life salvage value, s: 25,000

annual operating cost: 15,000 first 10 years, 20,000 thereafter

useful life, in years: 25

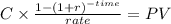

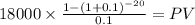

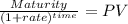

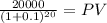

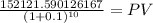

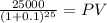

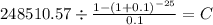

(a) determine which machine should be purchased, based on equivalent uniform annual cost.

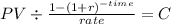

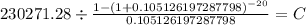

(b) what is the capitalized cost of machine i?

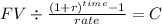

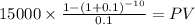

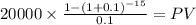

(c) machine i is purchased and a fund is set up to replace machine i at the end of 20 years. compute the required uniform annual deposit.

(d) machine i will produce an annual saving of material of $28,000. what is the rate of return if machine i is installed?

(e) what will be the book value of machine i after 2 years, based on sum -of -years' -digits depreciation?

(f) what will be the book value of machine ii after 3 years, based on double declining balance depreciation?

Answers: 2

Another question on Business

Business, 21.06.2019 18:00

Abc company currently pays a dividend of $2.15 per share, d0=2.15. it is estimated that the company’s dividend will grow at a rate of 30 percent per year for the next 3 years, then the dividend will grow at a constant rate of 7 percent thereafter. the market rate of return is 9 percent. what would you estimate is the stock’s current price?

Answers: 3

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Business, 23.06.2019 00:00

Which of the following statements is correct? a major disadvantage of a partnership relative to a corporation is the fact that federal income taxes must be paid by the partners rather than by the firm itself. in a typical partnership, liability for other partners’ misdeeds is limited to the amount of a particular partner’s investment in the business.true in a limited partnership, the limited partners have voting control, while the general partner has operating control over the business, and the limited partners are individually responsible, on a pro rata basis, for the firm’s debts in the event of bankruptcy. partnerships have more difficulty attracting large amounts of capital than corporations because of such factors as unlimited liability, the need to reorganize when a partner dies, and the illiquidity of partnership interests.

Answers: 1

You know the right answer?

Acompany is considering buying a new piece of machinery. a 10% interest rate will be used in the com...

Questions

Mathematics, 13.02.2020 19:57

Business, 13.02.2020 19:57

History, 13.02.2020 19:57