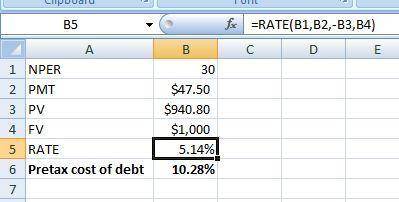

St. thomas company is planning to issue $1,000 par value bonds. the bonds will have a coupon rate of 9.5 percent and will be sold at a market price of $980. flotation costs will amount to 4 percent of market value. the bonds will mature in 15 years and coupon payments will be semi-annual. st. thomas' marginal tax rate is 35%. what is the firm's cost of debt financing?

a. 6.93%

b. 6.68%

c. 6.34%

d. 10.28%

e. 9.76%

Answers: 2

Another question on Business

Business, 22.06.2019 22:00

"jake’s roof repair has provided the following data concerning its costs: fixed cost per month cost per repair-hour wages and salaries $ 20,900 $ 15.00 parts and supplies $ 7.70 equipment depreciation $ 2,800 $ 0.35 truck operating expenses $ 5,720 $ 1.60 rent $ 4,690 administrative expenses $ 3,850 $ 0.50 for example, wages and salaries should be $20,900 plus $15.00 per repair-hour. the company expected to work 2,600 repair-hours in may, but actually worked 2,500 repair-hours. the company expects its sales to be $47.00 per repair-hour. required: compute the company’s activity variances for may."

Answers: 1

Business, 23.06.2019 00:50

Janis owns and operates a store in a country experiencing a high rate of inflation. in order to prevent the value of money in her cash register from falling too quickly, janis sends an employee to the bank four times per day to make deposits in a interest-bearing account that protects the store's revenues from the effects of inflation. this is an example of the (menu costs/ unit of account costs/ shoesleather costs) of inflation. pick one

Answers: 3

Business, 23.06.2019 09:00

Matthew decides to buy expensive designer jeans. less expensive jeans are available, but the added cost of the designer brand is worth it to matthew most likely because

Answers: 1

You know the right answer?

St. thomas company is planning to issue $1,000 par value bonds. the bonds will have a coupon rate of...

Questions

Social Studies, 30.07.2021 02:40

Computers and Technology, 30.07.2021 02:40