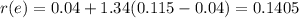

The common stock of detroit engines has a beta of 1.34 and a standard deviation of 11.4 percent. the market rate of return is 11.5 percent and the risk-free rate is 4 percent. what is the firm's cost of equity?

a. 10.05 percent

b. 12.98 percent

c. 14.05 percent

d. 15.50 percent

e. 15.67 percent

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

Describe three scenarios in which you might utilize mathematics to investigate a crime scene, accident scene, or to make decisions involving police practice. be sure to explain how math is used in police as they work through each scenario.

Answers: 1

Business, 22.06.2019 16:20

The assumptions of the production order quantity model are met in a situation where annual demand is 3650 units, setup cost is $50, holding cost is $12 per unit per year, the daily demand rate is 10 and the daily production rate is 100. the production order quantity for this problem is approximately:

Answers: 1

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

You know the right answer?

The common stock of detroit engines has a beta of 1.34 and a standard deviation of 11.4 percent. the...

Questions

English, 24.09.2019 17:40

Mathematics, 24.09.2019 17:40

Social Studies, 24.09.2019 17:40

Health, 24.09.2019 17:40

Biology, 24.09.2019 17:40

History, 24.09.2019 17:40

History, 24.09.2019 17:40

History, 24.09.2019 17:40

History, 24.09.2019 17:40

Mathematics, 24.09.2019 17:40

Biology, 24.09.2019 17:40

Mathematics, 24.09.2019 17:40

Social Studies, 24.09.2019 17:40

Biology, 24.09.2019 17:40