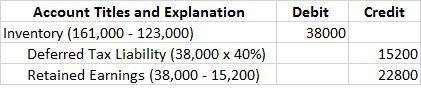

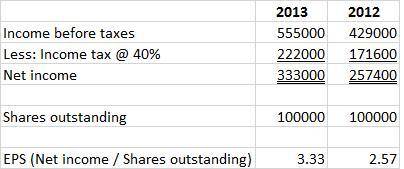

The cecil-booker vending company changed its method of valuing inventory from the average cost method to the fifo cost method at the beginning of 2013. at december 31, 2012, inventories were $123,000 (average cost basis) and were $127,000 a year earlier. cecil-booker’s accountants determined that the inventories would have totaled $161,000 at december 31, 2012, and $166,000 at december 31, 2011, if determined on a fifo basis. a tax rate of 40% is in effect for all years. one hundred thousand common shares were outstanding each year. income from continuing operations was $430,000 in 2012 and $555,000 in 2013. there were no extraordinary items either year. required: 1.prepare the journal entry to record the change in accounting principle. (if no entry is required for a particular event, select "no journal entry required" in the first account field.)2. prepare the 2013–2012 comparative income statements beginning with income from continuing operations. include per share amounts. (round eps answers to 2 decimal places.) comparative income statements 2013 2013 earnings per common share

Answers: 1

Another question on Business

Business, 21.06.2019 20:00

Which financial component is a mandatory deduction from your gross pay? a. sales tax b. social security tax c. health insurance d. disaster relief fund (drf) e. voluntary deduction

Answers: 1

Business, 21.06.2019 23:30

Consider the following scenarios. use what you have learned to decide if the goods and services being provided are individual, public, or merit goods. for each case, state what kind of good has been described and explain your answer using the definitions of individual, public, and merit goods. (6 points each) 1. from your window, you can see a city block that's on fire. you watch city firefighters rescue people and battle the flames to save the buildings. 2. while visiting relatives, you learn that your cousins attend a nearby elementary school that is supported financially by local property tax revenue. 3. you see a squadron of military jets flying overhead. 4. you find out that your aunt works for a defense manufacturing company that has several defense contracts with the government. she tells you that she works for a team that is producing a communications satellite. 5. your class visits a local jail run by a private, profit-making company that detains county criminals and is paid with tax revenue.

Answers: 1

Business, 22.06.2019 05:00

Ajewelry direct sales company pays its consultants based on recruiting new members. question 1 options: the company is running a pyramid scheme, which is illegal. the company is running a pyramid scheme, which is legal. the company has implemented a legal and ethical plan for growth. the company uses this method of compensation to reduce the fee for the product sample kit.

Answers: 3

Business, 22.06.2019 11:30

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

You know the right answer?

The cecil-booker vending company changed its method of valuing inventory from the average cost metho...

Questions

History, 11.02.2021 14:00

Physics, 11.02.2021 14:00

Biology, 11.02.2021 14:00

Mathematics, 11.02.2021 14:00

Advanced Placement (AP), 11.02.2021 14:00

Mathematics, 11.02.2021 14:00

Health, 11.02.2021 14:00

Mathematics, 11.02.2021 14:00

Health, 11.02.2021 14:00

Biology, 11.02.2021 14:00

History, 11.02.2021 14:00