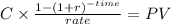

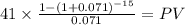

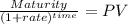

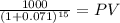

Anewly issued bond pays its coupons once a year. its coupon rate is 4.1%, its maturity is 15 years, and its yield to maturity is 7.1%.

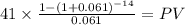

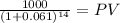

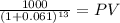

a. find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 6.1% by the end of the year. (do not round intermediate calculations. round your answer to 2 decimal places.)

holding-period return %

b. if you sell the bond after one year when its yield is 6.1%, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? the bond is subject to original-issue discount (oid) tax treatment. (do not round intermediate calculations. round your answers to 2 decimal places.)

c. what is the after-tax holding-period return on the bond? (do not round intermediate calculations. round your answer to 2 decimal places.)

d. find the realized compound yield before taxes for a two-year holding period, assuming that (i) you sell the bond after two years, (ii) the bond yield is 6.1% at the end of the second year, and (iii) the coupon can be reinvested for one year at a 2.1% interest rate. (do not round intermediate calculations. round your answer to 2 decimal places.)

e. use the tax rates in part (b) to compute the after-tax two-year realized compound yield. remember to take account of oid tax rules. (do not round intermediate calculations. round your answer to 2 decimal places.)

Answers: 3

Another question on Business

Business, 22.06.2019 06:10

P11.2a (lo 2, 4) fechter corporation had the following stockholders’ equity accounts on january 1, 2020: common stock ($5 par) $500,000, paid-in capital in excess of par—common stock $200,000, and retained earnings $100,000. in 2020, the company had the following treasury stock transactions. journalize and post treasury stock transactions, and prepare stockholders’ equity section. mar. 1 purchased 5,000 shares at $8 per share. june 1 sold 1,000 shares at $12 per share. sept. 1 sold 2,000 shares at $10 per share. dec. 1 sold 1,000 shares at $7 per share. fechter corporation uses the cost method of accounting for treasury stock. in 2020, the company reported net income of $30,000. instructions a. journalize the treasury stock transactions, and prepare the closing entry at december 31, 2020, for net income. b. open accounts for (1) paid-in capital from treasury stock, (2) treasury stock, and (3) retained earnings. (post to t-accounts.) c. prepare the stockholders’ equity section for fechter corporation at december 31, 2020.

Answers: 1

Business, 22.06.2019 16:40

Based on what you learned about time management which of these statements are true

Answers: 1

Business, 22.06.2019 17:00

Dan wants to start a supermarket in his hometown, and wants to get into the business only after finding out about the market and how successful his business might be. the best way for dan to gain knowledge is to:

Answers: 2

Business, 22.06.2019 18:00

During the holiday season, maria's department store works with a contracted employment agency to bring extra workers on board to handle overflow business, and extra duties such as wrapping presents. maria's is using during these rush times.

Answers: 3

You know the right answer?

Anewly issued bond pays its coupons once a year. its coupon rate is 4.1%, its maturity is 15 years,...

Questions

Mathematics, 17.01.2020 16:31

English, 17.01.2020 16:31

English, 17.01.2020 16:31

English, 17.01.2020 16:31

History, 17.01.2020 16:31

Mathematics, 17.01.2020 16:31

Mathematics, 17.01.2020 16:31

Mathematics, 17.01.2020 16:31

Advanced Placement (AP), 17.01.2020 16:31

Mathematics, 17.01.2020 16:31